Employee/Recipient Data Corrections and Copies

Last modified by Derek K on 2024/02/07 22:29

To Correct Employee/Recipient copies:

Choose the existing reports or form type "History" in your software.

Select "OK", "Accept", "Next", "Generate", or "Process".

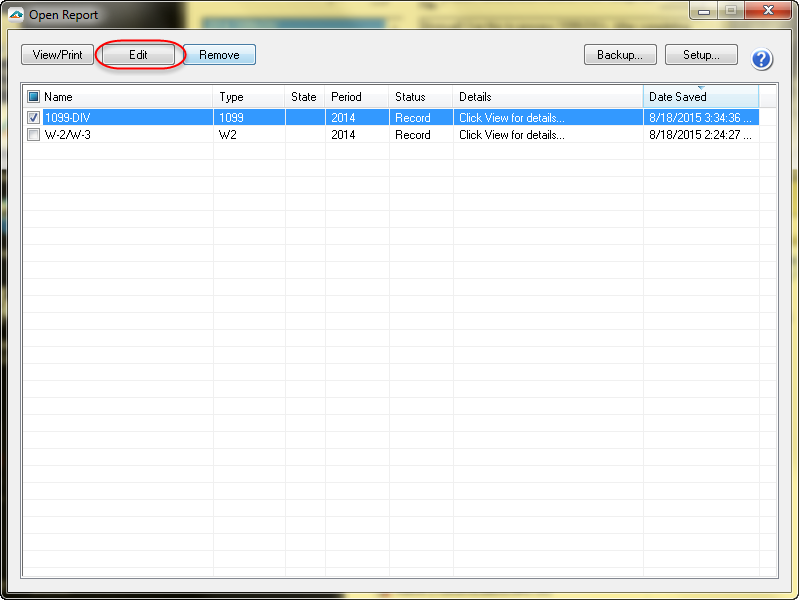

The "Open Reports" window will appear. Here, select the Record Copy of the W-2/W-3 or 1099 filing for the appropriate year.

You will see the "Record" under the "Status" column.

Once the Record copy is selected, choose to "Edit" the report.

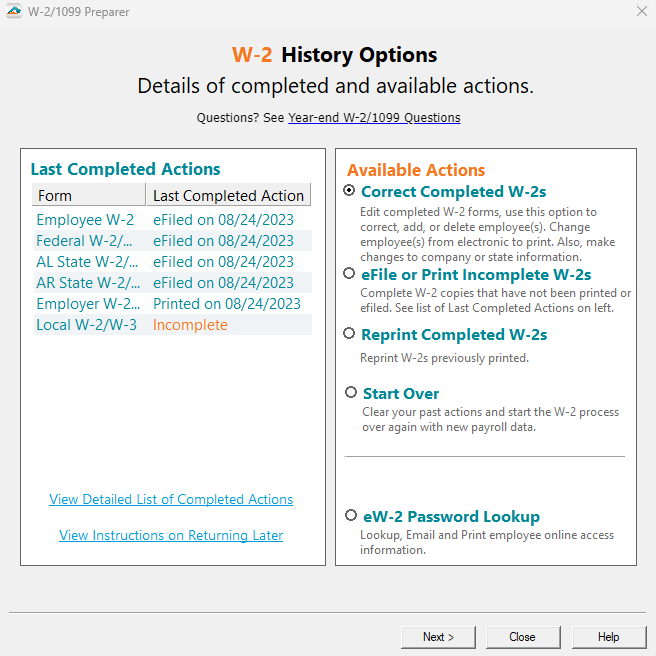

- Select the radio button beside the "Correct Completed" option and click "Next".

- The W-2/1099 Preparer will display. Here you can change any of the employee/recipient information.

To change any values including names, addresses, and SSNs/ITINs, simply select the box in the correct employee/recipient row and just type in the new value.

DO NOT remove employees/recipients that are not being corrected. They need to remain in your filing. Only remove employees/recipients if they, in fact, did not need a W-2/1099 form from your company.

Note: Once you change data in the Preparer the column and row will change to a Green color, this is also the indication that you are in correction mode.

For any data you change, the cell values will turn blue and the far left column in the row of the employee's name will turn green. Keep in mind that all the same error checking done in the Grid applies again just as the first time you went through.

For additional information on the Preparer functions:Depending on the status of your filing, you might see a variation of the employee/recipient copies. Please read the following articles on the Knowledgebase.

Related Pages:

Saving and History

Learn how to save your work in progress and access your history.

Corrected 1099 Information

Read more on Corrected 1099's.

State Corrections

Read more information about State Corrections.

W-2/1095/1099 Corrections

Learn how you can correct already completed filings.

W-2C Information

Read more on W-2C and corrections.