W-2C Information

Last modified by Derek K on 2024/02/07 22:29

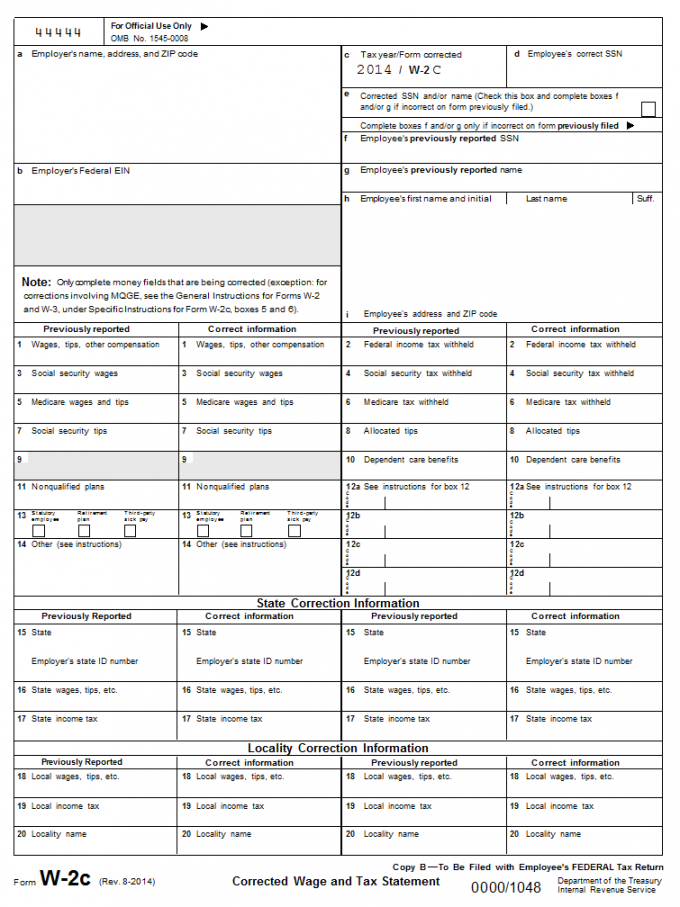

If you process corrections after a filing has been sent to the agency, the software will produce W-2Cs. The employee will receive a W-2C when the SSA portion of the original filing has been sent to the agency.

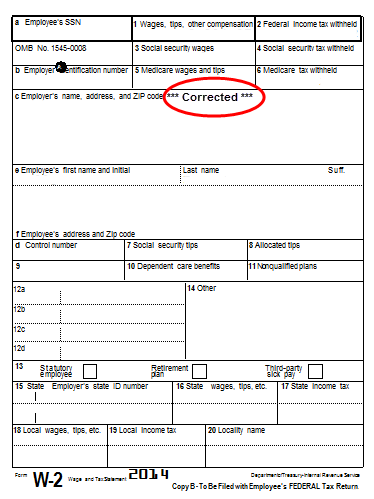

If the original filing has not been sent to the agency at the time of the corrections, the employee copies will show ***Corrected*** on the form.

The W-2C will display the information that was changed.

- If you are correcting an amount, the form will display the previous information from the original filing and then it will display the corrected amount.

Amounts NOT being corrected will NOT be displayed.

Name and SSN changes will be marked in the top right of the form.

The original information will display even if it is not corrected.