Truncation Options and Information

Last modified by Derek K on 2024/02/07 22:29

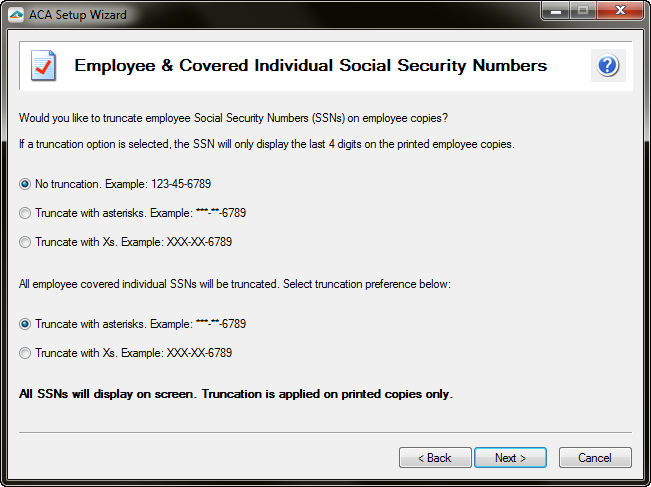

Employee Social Security Numbers (SSN) can be elected to be truncated or not. However, Covered Individuals are required to have the truncations on their SSNs.

- Employee Truncation options:

- No Truncations (display full SSN)

- Truncate first 5 digits of SSN with asterisks.

- Truncate first 5 digits of SSN with Xs. (X)

- Covered Individuals Truncation options:

- Truncate first 5 digits of SSN with asterisks.

- Truncate first 5 digits of SSN with Xs. (X)

- Truncate first 5 digits of SSN with asterisks.

Note: When the form displays in the Viewer it will not show the truncation options that were selected. The truncations will only display on the printed copy the employee receives.