Covered Individual Information

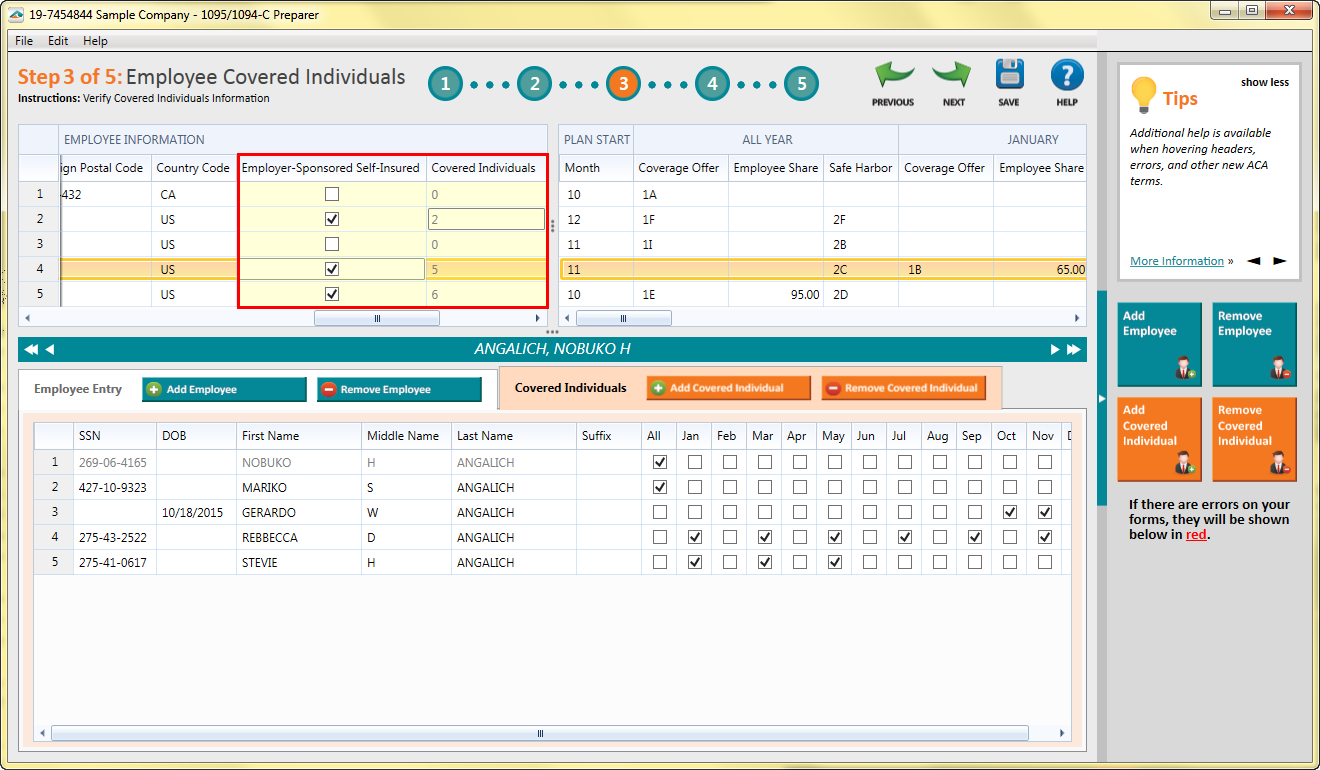

1094/1095-C Process:

Covered Individuals can only be reported when the Employer-Sponsored Self-Insured check box is checked for the specific employee(s) who have enrolled in the coverage. If the employee is not enrolled in the Insurance, do not report anything in this portion and make sure the checkbox is de-selected.

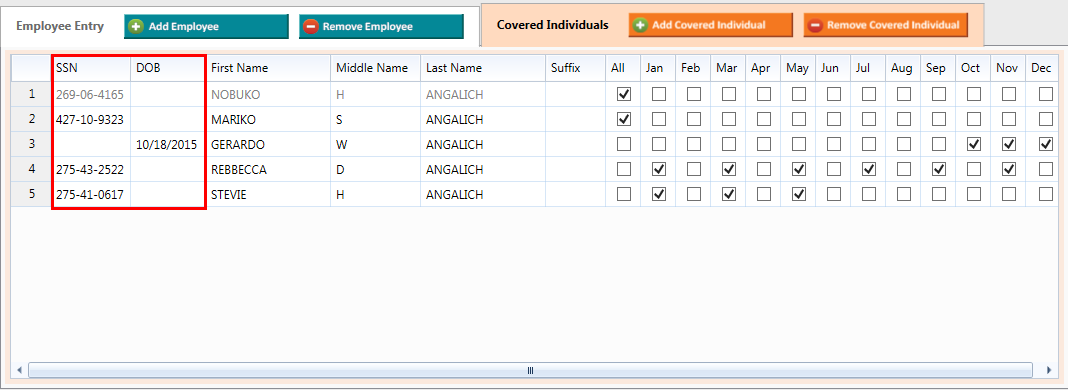

The Covered Individual(s), not including the employee, may be reported with their birthdate, if the SSN is not available.

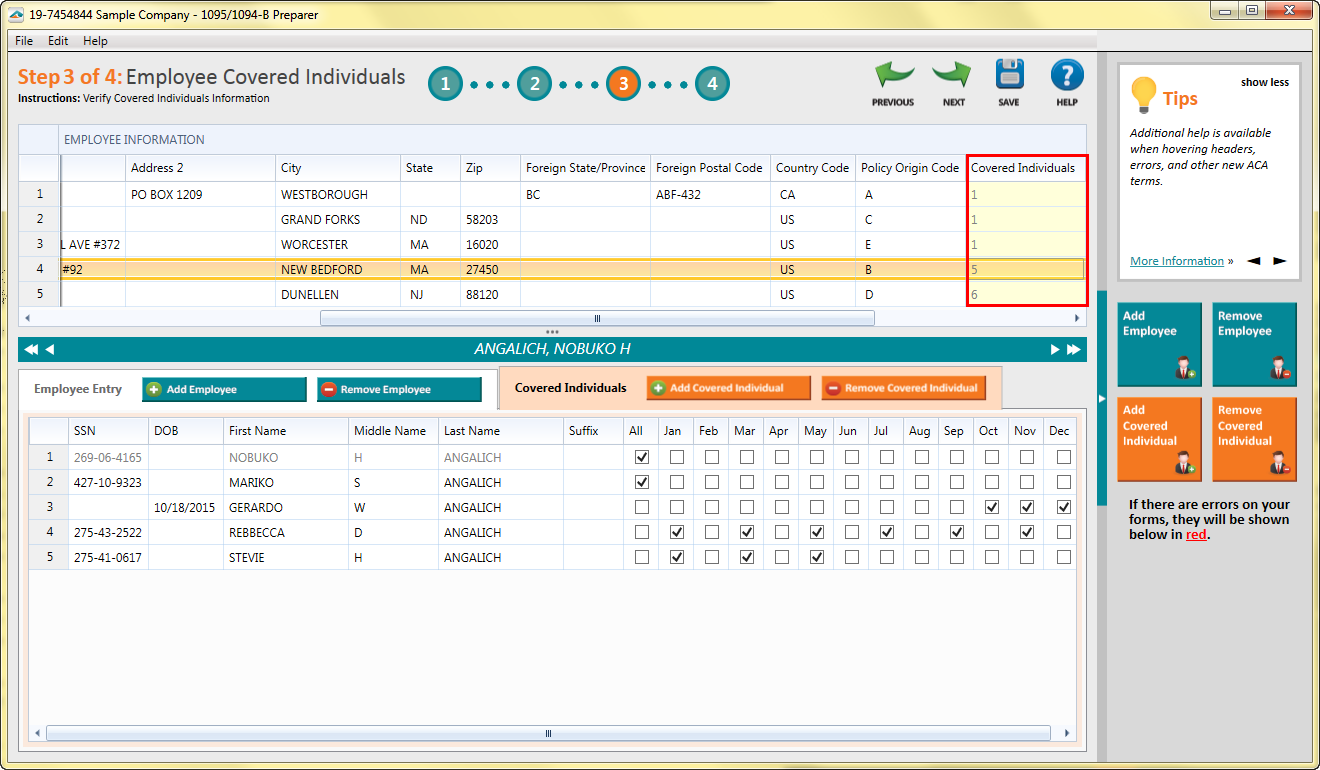

1094/1095-B Process:

Employees who enrolled in the Self-Funded Insurance will be reported on the 1095-B. This process is usually for businesses that employ less than 50 full-time employees and Insurance Providers. If you have questions about what form to use, please visit https://www.irs.gov/affordable-care-act/employers, or the instructions to the ACA publications.

All employees listed will be required to report the employee themselves as a covered individual. Covered individuals will automatically populate if passed by the payroll software. If this information is not passed then it can be manually entered.

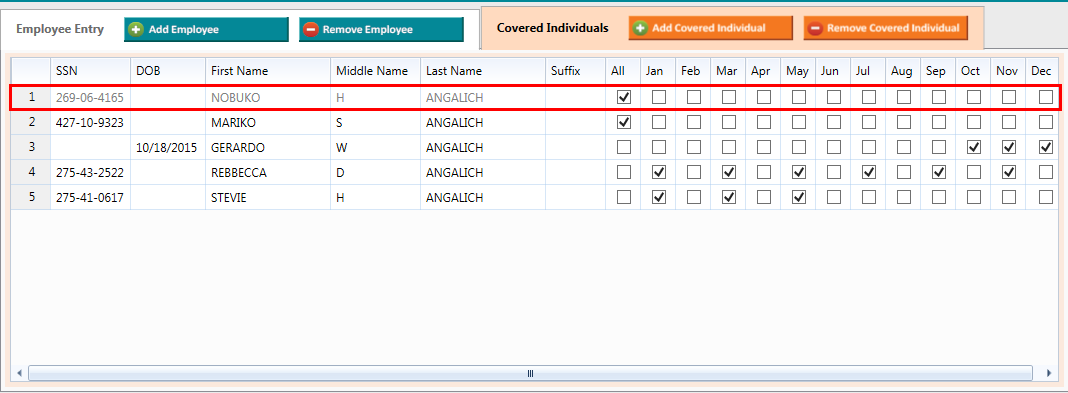

Employee listed as a Covered Individual

Employees that enrolled in the Self-Funded Insurance are required by the IRS to be listed first under the Covered Individuals section, with a SSN. Since the SSN is required, the Date of Birth (DOB) will not be utilized.

Changes to the employee’s information in the Covered Individual area must be changed in the employee entry section.

Note: Their information will not be editable in the Covered Individual section with the exception of the Monthly coverage check boxes.

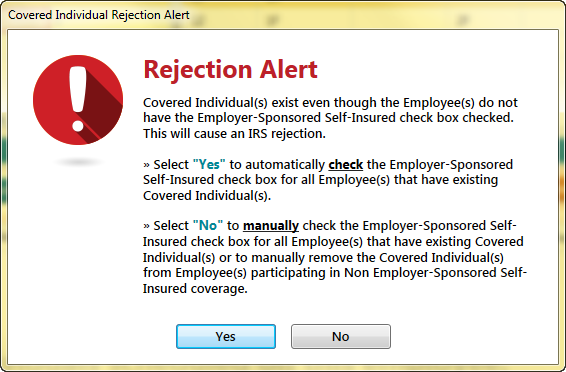

Rejection Alerts

After de-selecting a checkbox for the Employer-Sponsored Self-Insurance on a specific employee, any Covered Individuals under that employee will be removed.

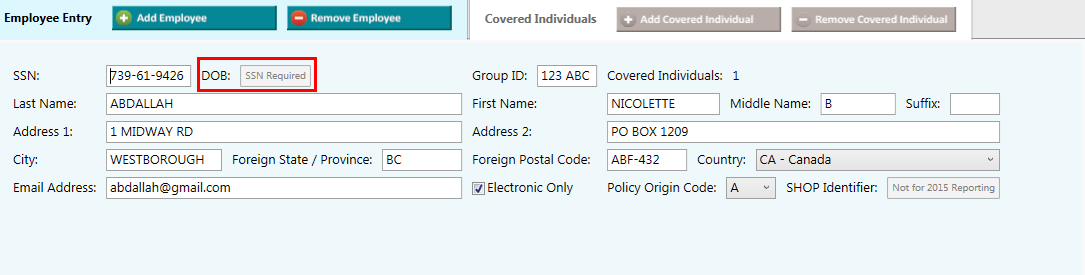

Covered Individuals

Either a Social Security Number (SSN) OR a Date of Birth (DOB) must be present for each covered individual, not both. While it is preferred to have the SSN, a DOB is acceptable by the IRS for Covered Individuals only.

SSNs for Covered Individuals will always be truncated with either asterisks ![]() or by X’s and will only display the last four numbers of the SSN. Truncation options are selected in the Company Setup.

or by X’s and will only display the last four numbers of the SSN. Truncation options are selected in the Company Setup.

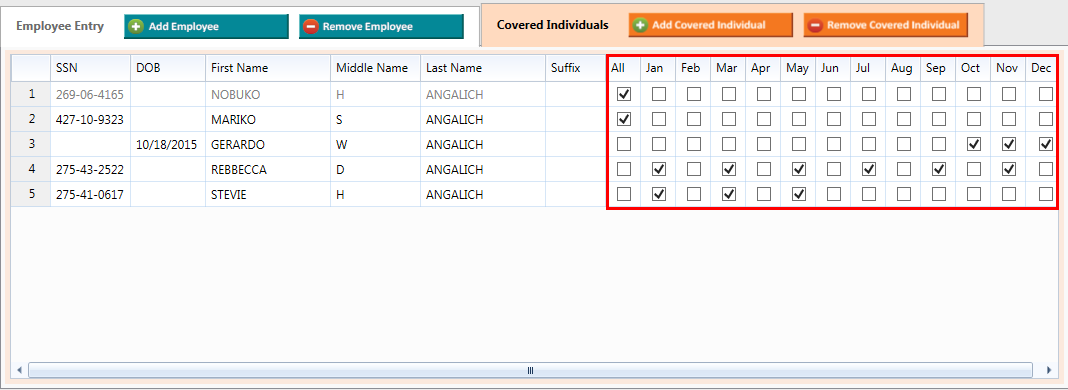

The individuals listed on the Covered Individuals tab must have a minimum of one month selected as covered during the year. Select the months the individual was covered for at least one day of the month.

Additional Information: