Indicate the Combining of W-2 and 1095s

Combining W-2 and 1095

The option to combine the W-2 filing with the ACA filing is only available with the Complete W-2 Service.

- W-2 Process

- The option to combine the filings is located in the eFile Session.

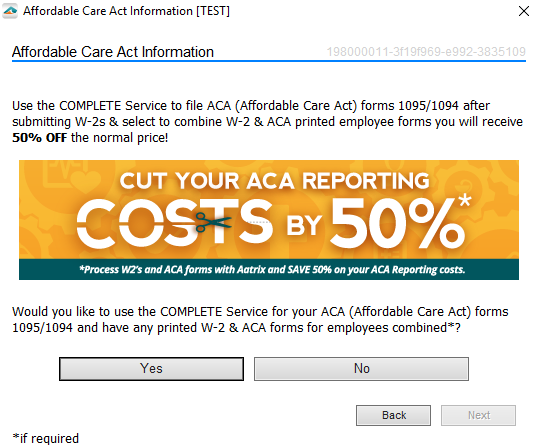

- Once logged into the eFile session, you will see the Affordable Care Act Information screen

- Here you will choose Yes to combine the W-2 and ACA forms.

- The option to combine the filings is located in the eFile Session.

When choosing the W-2 submission dates, select a future date allowing enough time to submit the complete ACA filing. The ACA filing must be submitted a minimum of 3 business days prior to the date selected for the employee W2 copies.

If the W-2 employee copies are processed by the time you submit the ACA filing, you will not qualify for the 50% discount.

Once the Complete W-2 Service is submitted, you can then file the ACA forms using the Complete service.

- ACA Process

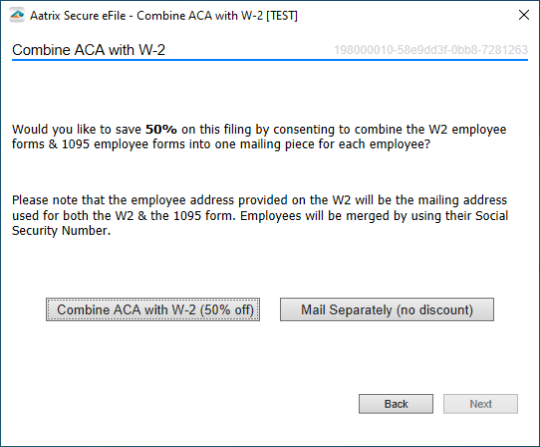

- To confirm that you are able to combine the returns, there will be an additional screen during the eFile Session to confirm the combining of the returns.

- On the Combine ACA with W-2 screen, select Combine ACA with W-2 (50% off) option.

- To confirm that you are able to combine the returns, there will be an additional screen during the eFile Session to confirm the combining of the returns.

When choosing the ACA submission date for the employees, the date chosen will also update the date of the employee W-2 submission. This date will be the date that the employee W-2s and 1095s are going to be mailed.

Additional Information: