Foreign Employees

Last modified by andrew k on 2026/01/27 20:42

If you have employees with foreign addresses, you can print or eFile their ACA forms using the ACA Preparer. The only difference is that you must indicate the foreign address information in different columns in the Preparer.

Follow these steps:

- Enter the ACA Preparer from the "Forms Selection" screen. Select the 1094/1095-B or 1094/1095-C forms listed and select to process the report.

- Note: The process may vary depending on your payroll software.

- Complete the Company Setup.

- Continue to the ACA Preparer.

- Your foreign employees will be automatically detected and populate into the Preparer.

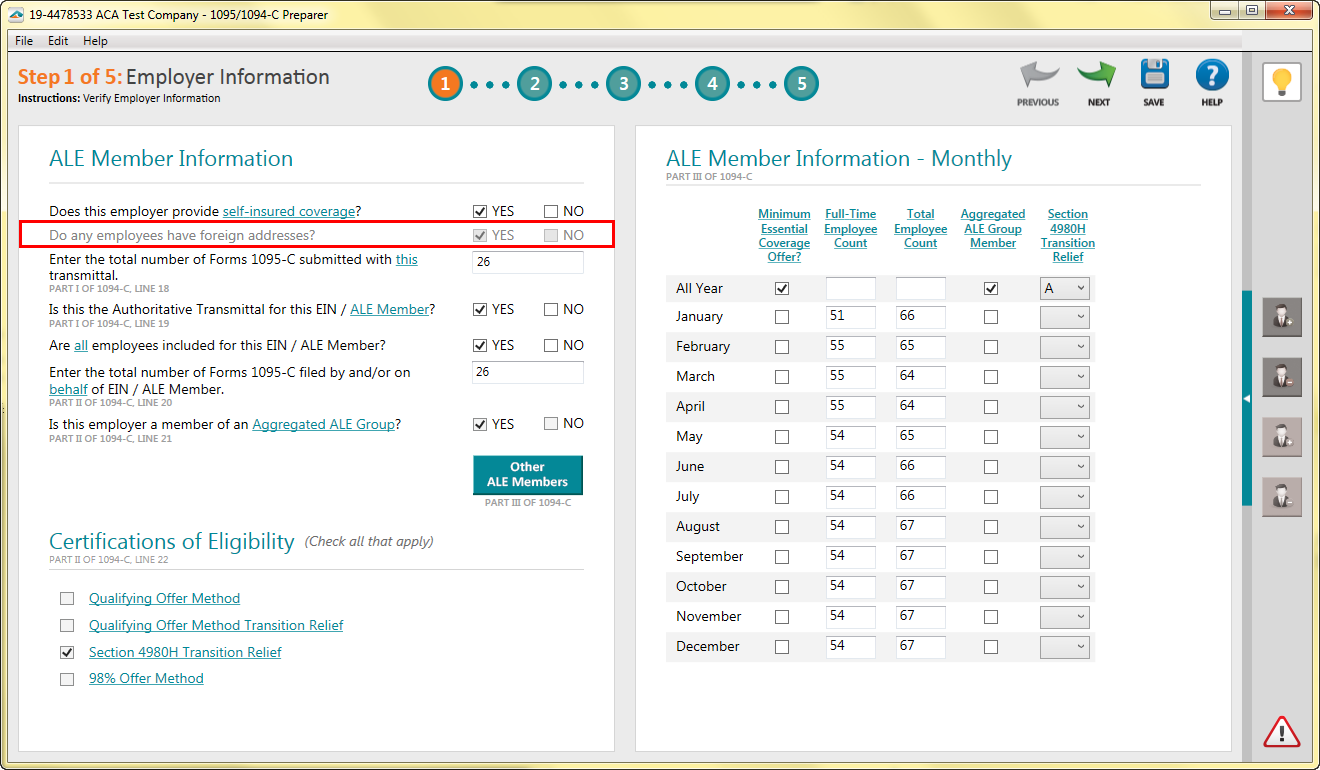

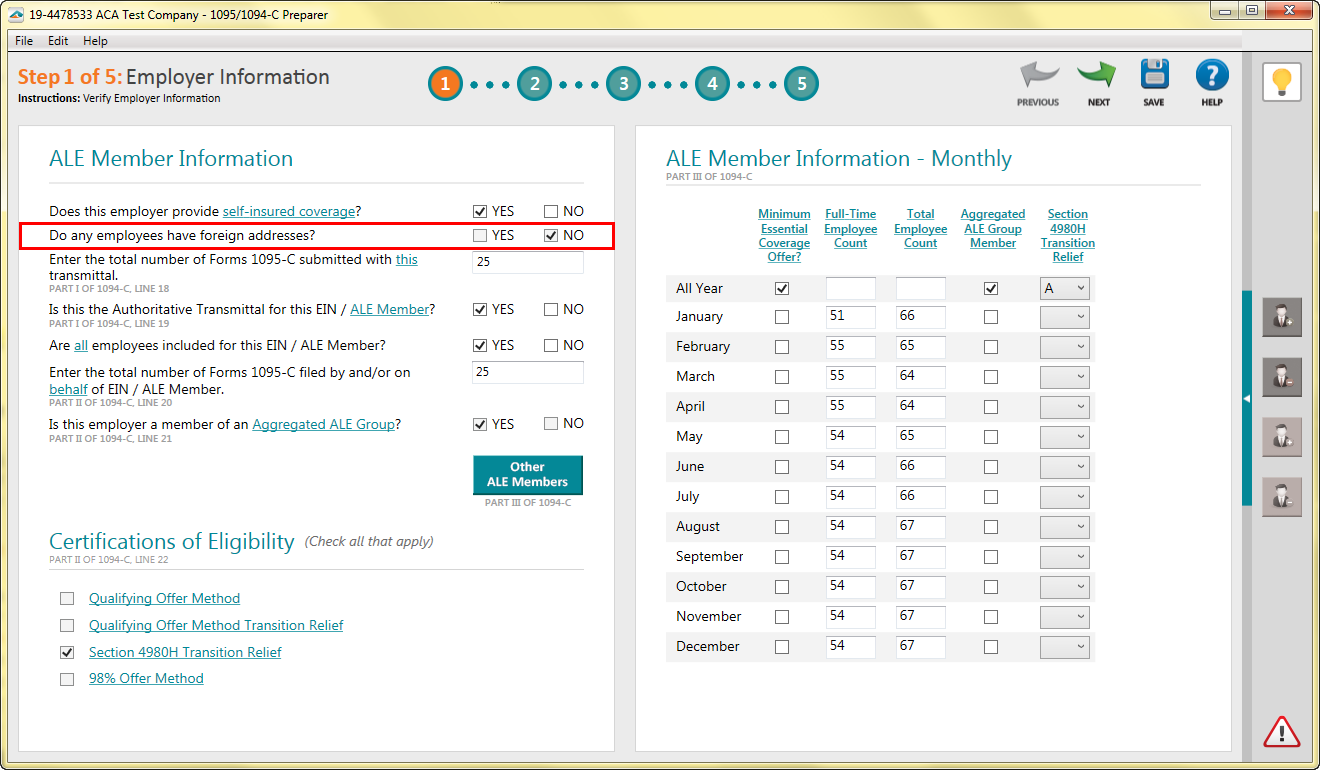

- If the foreign employees need to be entered manually for the 1094/1095-C Process please indicate you have foreign employees by changing the check box from "No" to "Yes"on Step 1 in the ACA Preparer.

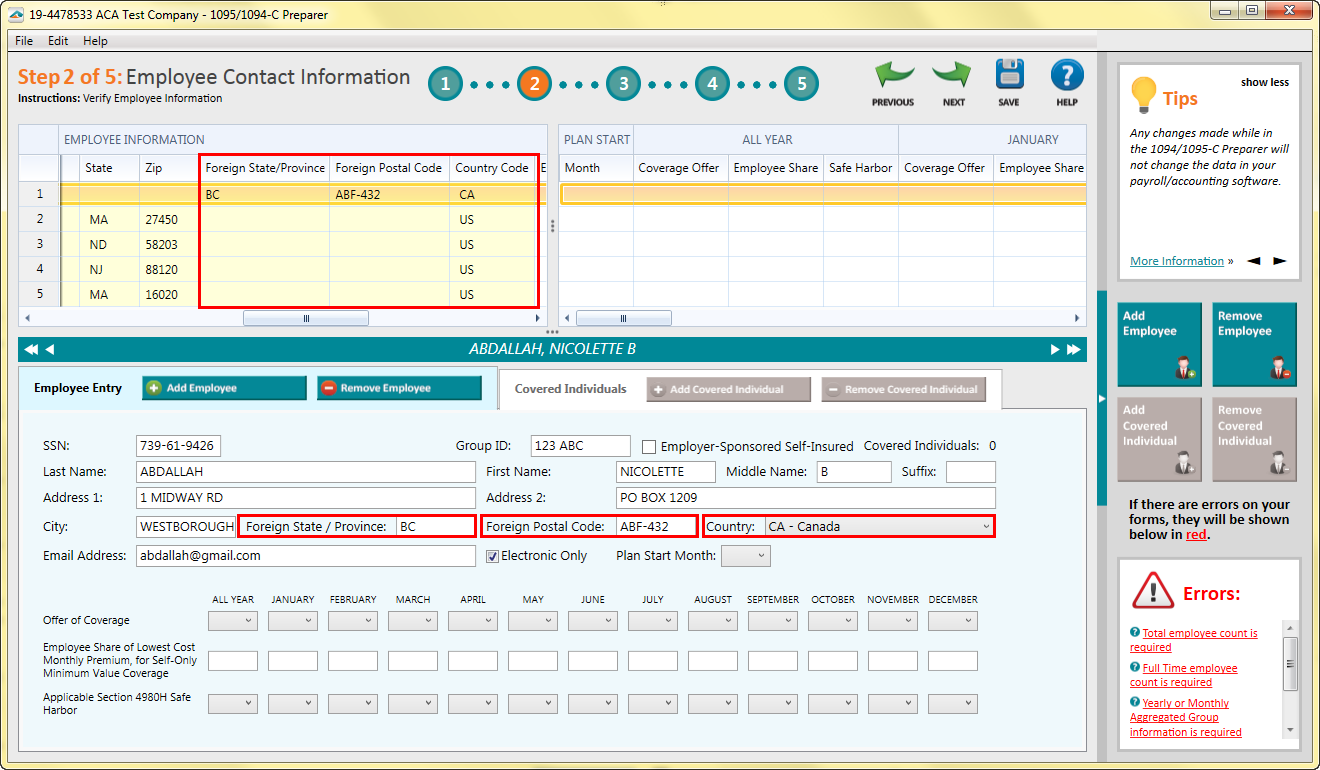

- The following rules apply when entering foreign addresses for applicable employees:

- If data is listed in the foreign address fields, you cannot have a US address (except address line 1 and 2).

- Country Code must be two characters.

- Foreign state/province cannot be blank if other data is entered.

- Foreign postal code cannot be blank if other data is entered.

- When you have entered the employee's foreign address, the ACA Preparer should look similar to this:

- You may then continue through the ACA Preparer. The ACA forms for the employees will appear with the correct address information.

Additional Information: