Reporting to Multiple States

Last modified by Derek K on 2024/02/07 22:29

If you have multiple states to file W-2s/1099s with, you can easily do that in the W-2/1099 Preparer.

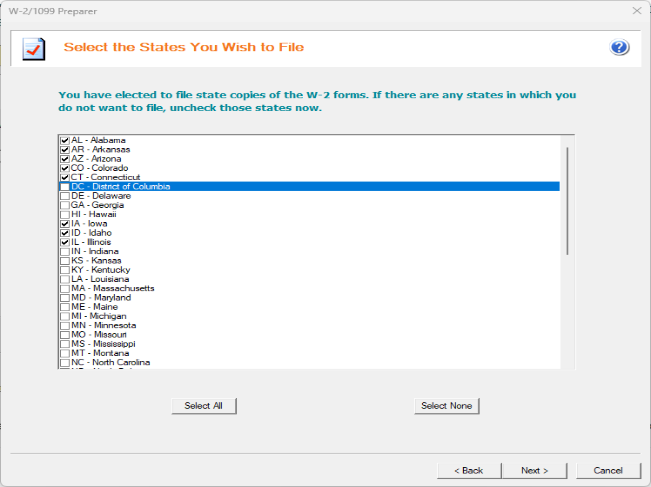

On the "Pricing and Processing" screen, if you select an eFile option that includes State Filings, you will see a screen where each state that is currently indicated in your employee payroll data can be checked or unchecked.

Just make sure all states that you want to eFile the W-2s/1099s for are checked and the eFile center will take care of the rest.

Note: It is suggested to file all states at the same time. You are able to replace the filing for free before it is submitted to the agency if mistakes are found.