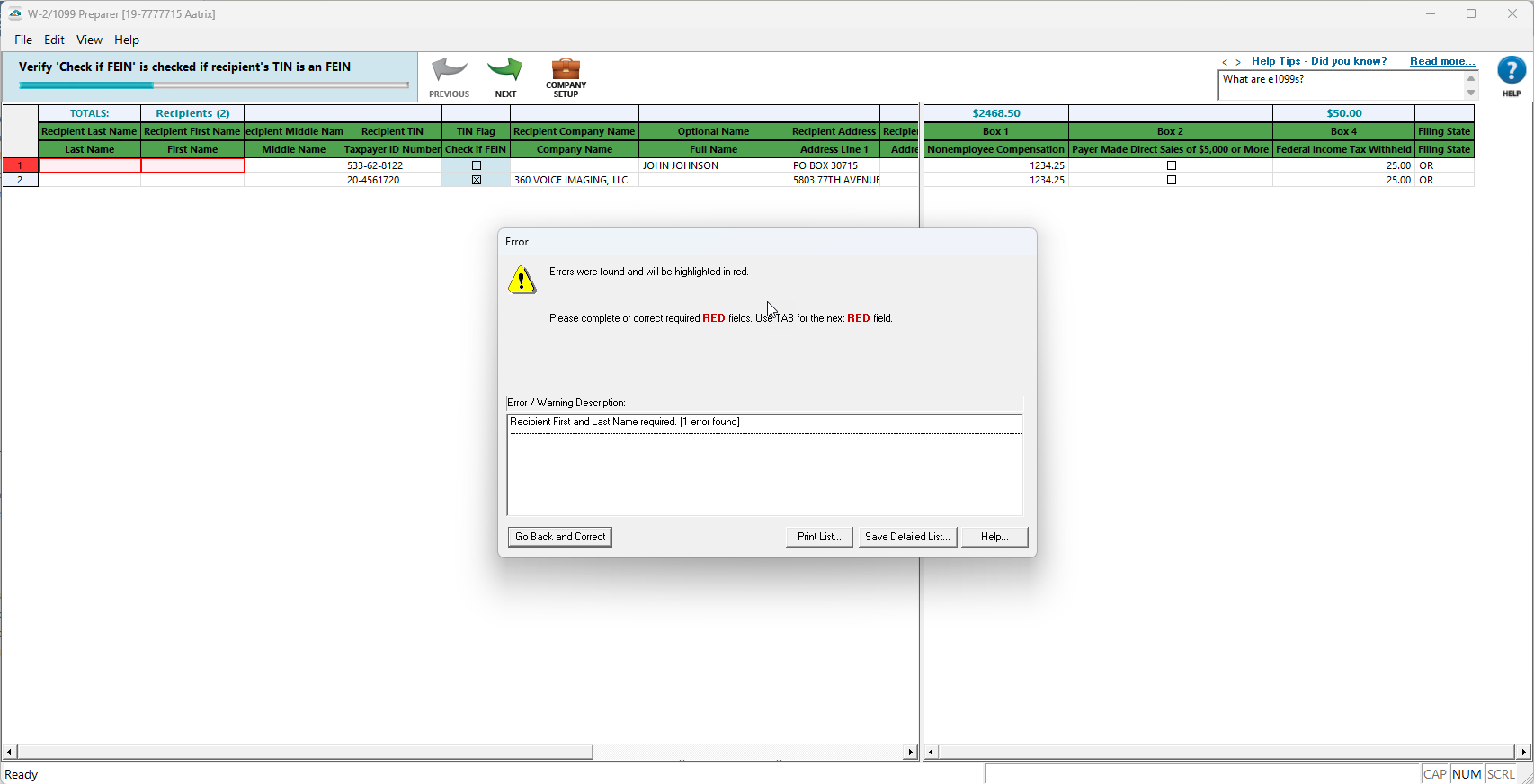

Recipient First and Last Name required

For 2023 and beyond, Aatrix will use the new IRIS system to file 1099s to the IRS. With this change, there is also a change in the requirements of where a Recipient name should be in the file. Previously, the IRS allowed First Name and Last Name to be sent in the Full Name slot; now, if the TIN is an SSN or ITIN, the First Name and Last Name must be entered in those respective columns in the Preparer.

If your Accounting software has not made adjustments for that, you may have to manually edit the Preparer. This page will help you take the data from the Full Name column and place it in the First Name and Last Name columns.

If you see the error message: "Recipient First and Last Name required." The below steps may be helpful.

The rule: If the TIN Flag is an SSN (not checked as EIN) then First Name and Last Name fields are required.

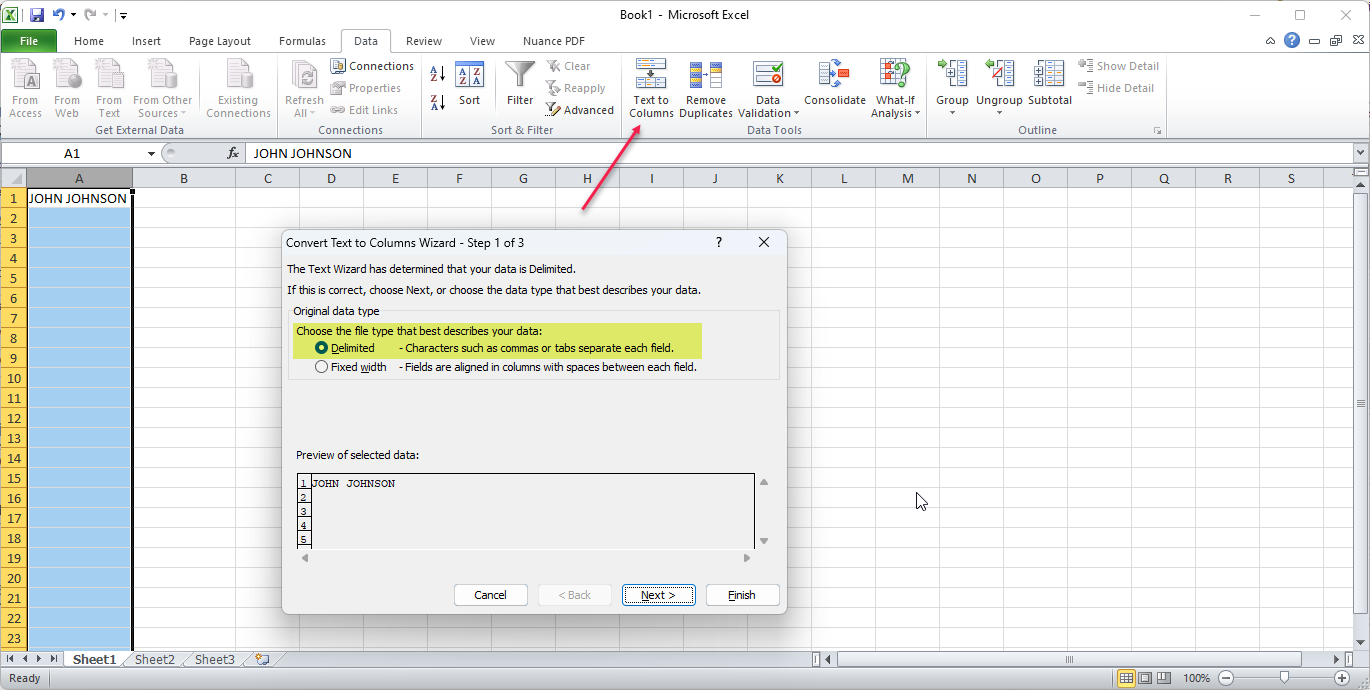

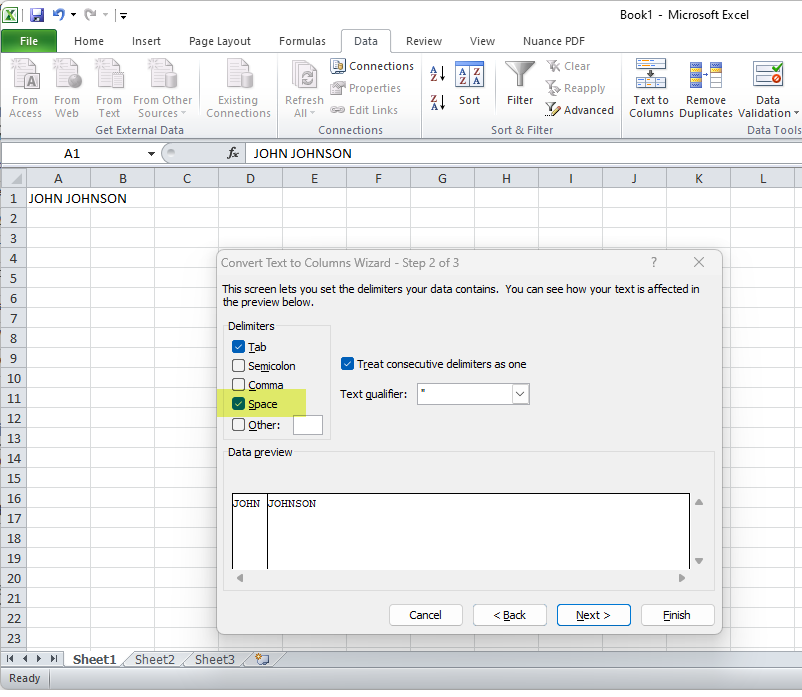

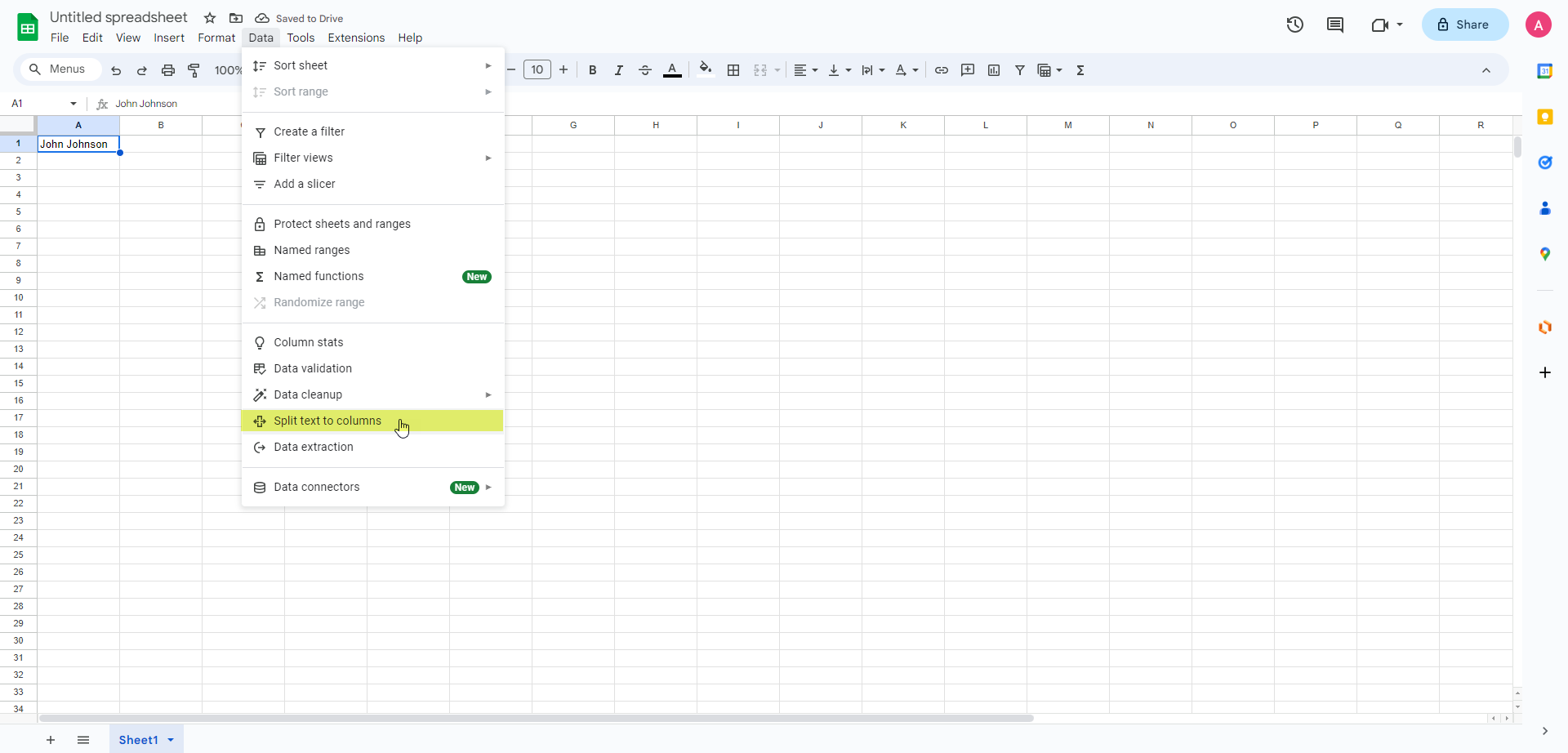

Copy and paste the Full Name column into Excel or Google Sheets (note: Excel is needed to use the CSV import process). Highlight the field and separate the text into columns - directions below based on what program you use.

EXCEL:

Google Sheets:

You will then see the first name and last name separated so you can copy and paste the column into the preparer OR you can import csv into the preparer.

Once you copy/paste or import, the error will go away, and you can move forward: