Processing States and Localities

At this time, Aatrix only supports certain localities during the W-2 process.

The following states do not require W-2's and will not appear during the W-2 process.

- Alaska

- California

- Florida

- Nevada

- New Hampshire

- New York

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

Note: If your state is not listed above, then W-2's are required by that state and the forms will display during the W-2 process.

Aatrix supports filings for the following localities as part of the W-2 process for the tax year 2023.

- Delaware

- Wilmington

- Michigan

- Albion

- Battle Creek

- Benton Harbor

- Big Rapids

- Detroit

- East Lansing

- Flint

- Grand Rapids

- Grayling

- Hamtramck

- Highland Park

- Hudson

- Ionia

- Jackson

- Lansing

- Lapeer

- Muskegon

- Muskegon Heights

- Pontiac

- Port Huron

- Portland

- Saginaw

- Springfield

- Walker

- Missouri

- Kansas City

- St. Louis

- Ohio

- Anna

- Arlington

- Ashtabula

- Blendon

- Blue Ash

- Botkins

- Bowling Green

- Brimfield-Kent

- Brookville

- Butler JEDD

- Butler JEDZ

- Canfield

- Canton

- Carey

- CCA

- Cheviot

- Cincinnati

- Columbus IT

- Columbus IT-13J

- Covington

- Cridersville

- Dayton

- Fairfield

- Findlay

- Forest Park

- Fort Loramie

- Hicksville

- Hubbard

- Kent-Franklin

- Lakeview

- Lancaster

- Lebanon

- Liberty JEDD

- Lisbon

- Lorain

- Louisville

- Mansfield

- Massillon

- Middletown

- Minster

- Monroe

- Moraine

- Mount Blanchard

- Mount Cory

- Napoleon

- New Bremen

- New Knoxville

- North Star

- Norwood

- Osgood

- Plain City

- Rita

- Russia

- Saybrook JEDD

- Sherwood

- Springdale

- St. Marys

- Vandalia

- Vanlue

- Warren

- Westerville

- Zanesville

- Pennsylvania

- PA Act 32 Reports

- Philadelphia

During the W-2 Process, the localities will be entered and linked through the Company Setup inside the State and Local tax items. Once the locality is properly linked, the necessary local forms will populate.

You will also want to make sure that the state associated with the localities is set up on the State and Local tax items as well.

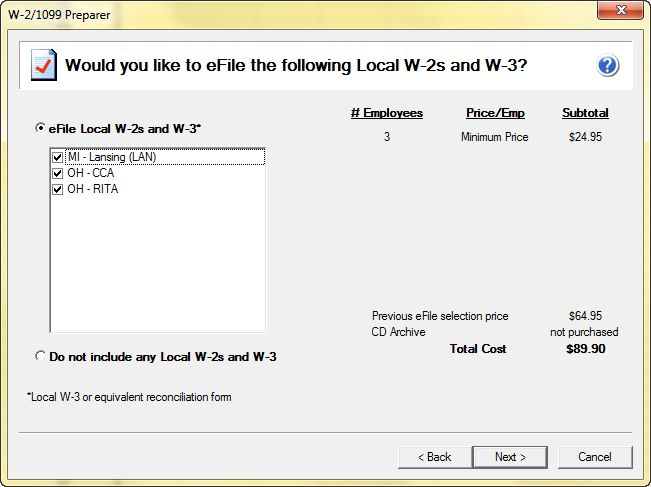

When you continue through the W-2 process, you will receive a prompt to choose your filing options. Once the state is selected, the software will confirm the state(s) indicated by the payroll data. After the state(s) are selected, an option to choose the localities will follow.

Note: If you do not receive this option, return to the grid and update your company setup to include your local tax items