Pennsylvania Supported Localities (PA Act 32)

Currently, we only support the localities included in the PA Act 32 for monthly and quarterly filing.

Note: If you wish to request to have Aatrix support another locality, please contact your payroll software provider and request the form. Aatrix does not support Local Services Tax (LST) or School District (SD) tax for the state of Pennsylvania.

Below are the additional steps taken when a company has reporting requirements for PA Act 32. When filing quarterly reports, choose the PA Act 32 Report Selection form in the PA state forms list within your accounting software. The Company Setup Wizard will guide you through the following screens.

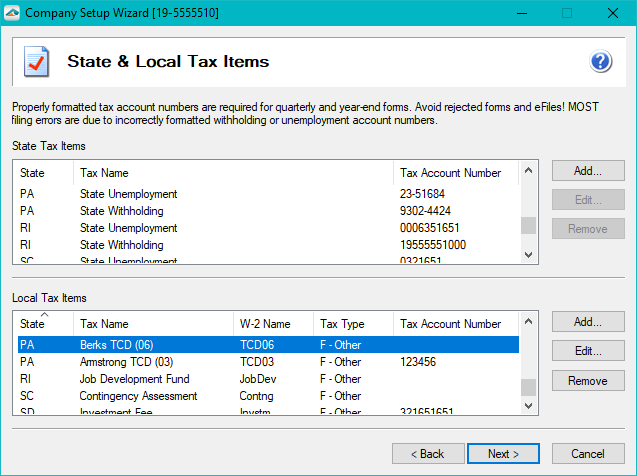

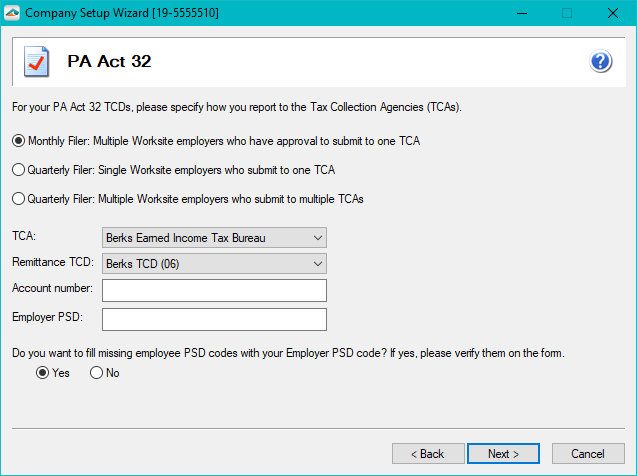

If there are any PA ACT 32 locals in the Local Tax Items section, then the PA ACT 32 screen will prompt for the reporting frequency.

If your company is a Monthly or Quarterly filer that reports to 1 TCA (Tax Collection Agency), then select the TCA and Remittance TCD (Tax Collection District). Account Number and Employer PSD are not required, but will be useful in filing in the forms.

Note: If the TCA the company needs to report to is not listed, then check to make sure the correct TCD is entered in the previous screen for the State and Local Tax items.

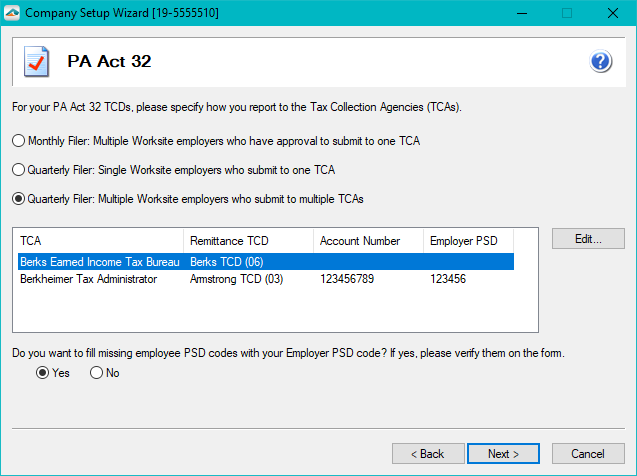

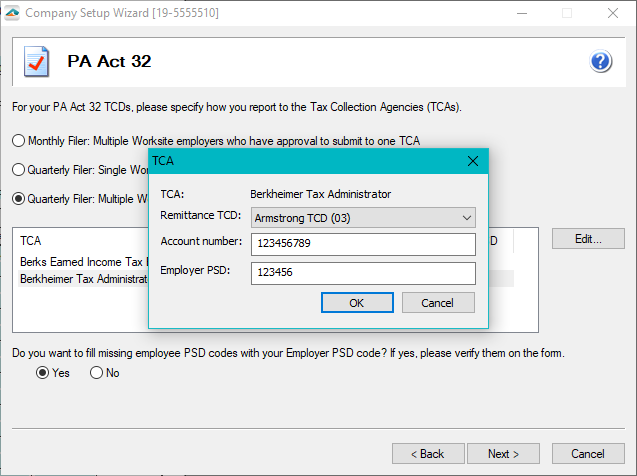

If the company is a Quarterly Filer that reports to multiple TCAs, then you will be able to add the information for each TCA that corresponds with the TCDs entered on the State and Local Tax Items screen.

Note: If the TCA the company needs to report to is not listed, then check to make sure the correct TCD is entered in the previous screen for the State and Local Tax items.

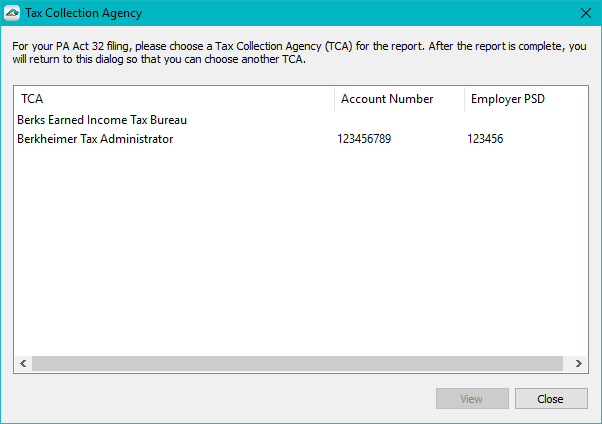

Edit each TCAs information by either double clicking on the data that you would like to edit or select the TCA from the list and click Edit.

Additional Information: