eFile Form Validation

Last modified by andrew k on 2026/01/27 20:42

Aatrix has added an enhancement to the eFile process: eFile Form Validation. To maintain compliance with agency electronic filing guidelines, you may be presented with a list of warning(s) and/or error(s) after electing to eFile. This enhancement will draw attention to any items that may cause agency rejections prior to submitting the filing, potentially saving time and money, while reducing the risk of fines and/or penalties. Currently, validations are only performed during the eFile process.

There are three (3) levels of validation:

I. Warning

The first level is a warning. Warnings bring attention to items that should be reviewed or to take note of, but you are able to continue without correcting.

Example: Unemployment Rate is too high.

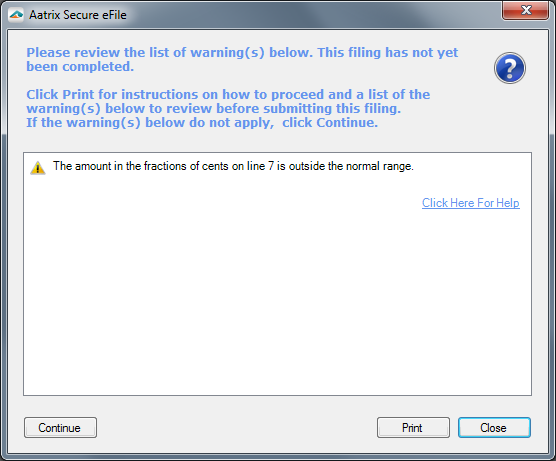

Warning Screenshot

Warning Options:

- Continue – If warnings do not apply, click continue to proceed to the eFile process.

Close – Closes the Secure eFile Client and returns to the form in the "Review / Edit" step.

Print – Prints instructions including the list of warnings.

Warning Print Instructions:

Below is a list of warnings that can be reviewed and edited on the form, if necessary. If the warnings below do not apply, click "Continue".

There are two (2) available options:

A. Review/Edit the Form

Click "Close"

The form will automatically return to the "Review / Edit" step. Review the list of warnings below and determine if any changes are necessary.

Once all the warnings have been reviewed, and any necessary changes completed, click "Next Step" and follow the instructions at the top of the Form Viewer to return to the eFile process.

B. Update information in the accounting/payroll software.

Click "Close".

The form will automatically return to the "Review / Edit" step.

Close the form, click "No" when prompted to save your work-in-progress.

Update the information in the accounting/payroll software that is causing these warnings. For questions on how to update/change the information, please contact your accounting/payroll software support team.

After updating the information in the accounting/payroll software, generate a completely new form.

II. Editable Errors

The second level of errors are editable. These include items that can be changed on the form before submitting the filing, or can be changed in the accounting/payroll program to permanently address the error and then generate the form again.

Example: Invalid Social Security Number (SSN).

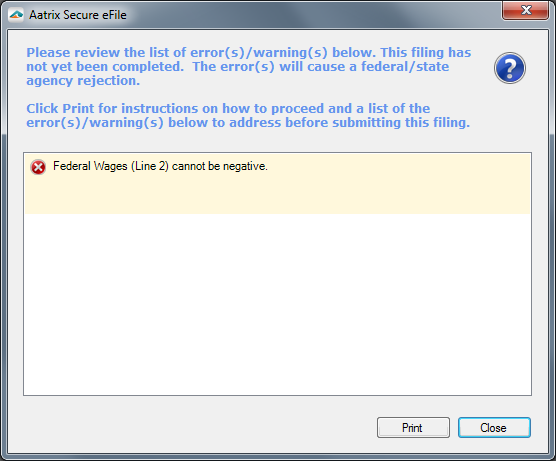

Editable Error Screenshot

Editable Error Options:

Print – Prints instructions including the list of editable errors.

Close – Closes the Secure eFile Client and returns the form back to the "Review / Edit" step.

Editable Errors Print Instructions:

Below is a list of error(s)/warning(s) that need to be addressed before the filing can be submitted. The error(s) will cause a federal /state agency rejection.

There are two available options:

A. Review/Edit the Form

Click "Close"

The form will automatically return to the "Review / Edit" step. Review the list of warnings and make necessary changes.

Once all the warnings have been addressed, click "Next Step" and follow the instructions at the top of the Form Viewer to return to the eFile process.

B. Update information in the accounting/payroll software.

Click "Close".

The form will automatically return to the "Review / Edit" step.

Close the form, then click "No" when prompted to save your work-in-progress.

Update the information in the accounting/payroll software that is causing these warnings. For questions on how to update/change the information, please contact the accounting/payroll software support team.

After updating the information in the accounting/payroll software, generate a completely new form.

III. Fatal Errors

The third level of errors require an entirely new form to be generated because of an invalid start and/or end date selection. The only option with this type of error is to close the form and generate a new one. If error(s)/warning(s) exist other than fatal errors, then additional instructions are provided.

Example: CA DE-88 Coupon is selected for a quarter, and the monthly box is checked on the form to indicate a monthly filer. This would require a new CA DE-88 to be generated for a monthly date range.

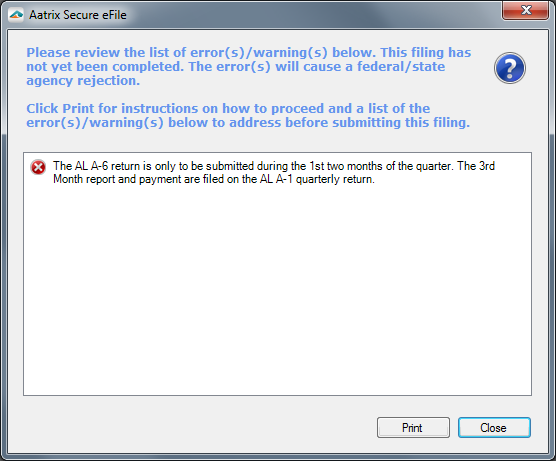

Fatal Error Screenshot

Fatal Error Options:

Print – Prints instructions including the list of editable and fatal errors.

Close – Closes the Secure eFile Client, the form, and deletes the history.

Fatal Errors Instructions:

Below is a list of errors that need to be addressed before the filing can be submitted. These errors will cause a federal/state agency rejection.

Click "Close".

The form will automatically close and will be removed from the company history.

One or more of the errors below require that a new form is generated using the correct period start and end dates when selecting the form from the form selection screen.

If error(s)/warning(s) exist other than period start and end dates, there are two available options to address these error(s)/warning(s):

Update the information in the accounting/payroll software that is causing these error(s)/warning(s).

For questions on how to update/change the information, please contact the accounting/payroll software support team.

Generate a completely new form using the correct period start and end date when selecting the form, then review the list of error(s)/warning(s) and make necessary changes on the new form.

Related Pages:

Incorrect Information on Forms

Learn what is happening when incorrect information is populating on the form.

Finding the Form Selection Screen

Read more about the "Form Selection" screen.

Replacing / Resubmitting an eFiling

Learn how to replace and resubmit an eFiling.

Merging

Learn more about merging.

Social Security Number Information

Learn about valid Social Security Numbers.