Account Number Formatting

Last modified by Derek K on 2024/02/07 22:29

When using Aatrix for State and Federal Tax Filings, the information on the report is being populated using a data file created by the Payroll Software. In some cases, the Account Number may not be set up correctly and require adjusting. This can be completed by adjusting it directly in the Payroll Software and regenerating the report or using the following steps to adjust it within Aatrix.

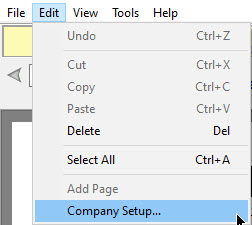

Once the form is open, in the upper left-hand corner click on Edit and Company Setup.

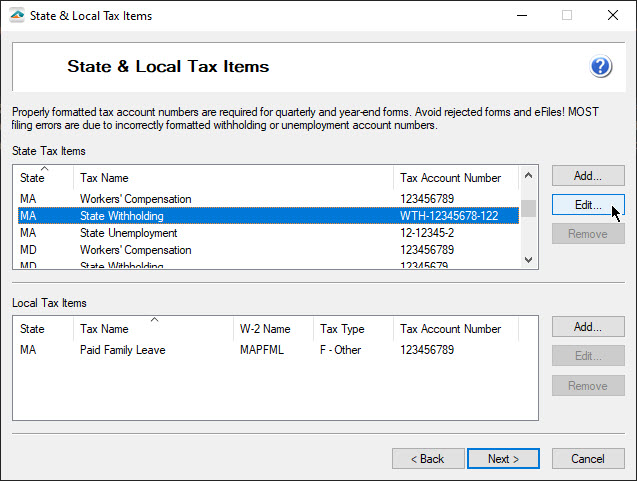

Proceed by clicking Next until you see the State & Local Tax Items screen.

From here, select the particular Tax Account Number that is incorrect and click Edit.

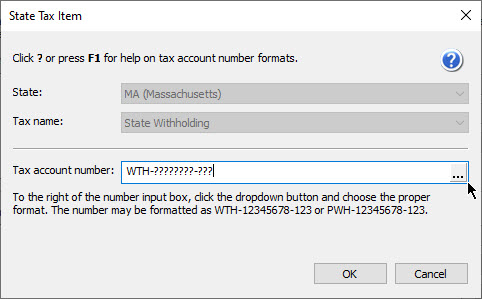

This will bring up a window to update the account number. In the case that the format is not correct, clicking on the three dots to the right will allow for alternate formatting.

Note: Depending on the state requirement, some characters within the account number will be hardcoded, whereas the question marks are editable.

After finalizing the account number set up, proceed by clicking Next until you are back on the form. From here, the following message will appear. Close out of the form and then reopen it to see the changes to the account number.