1095-C eFiling Process

To start processing forms, navigate to the "Form Selection" screen.

- The Form Selection Screen can be found in your accounting/payroll module.

- The Form Selection Screen location will vary depending on what accounting/payroll software you are using. As a general rule, if you are having troubles finding the form selection screen, contact your accounting/payroll software support.

- Once the 1094/1095-C form is chosen from the Federal Form Selection menu, select "OK", "Accept", "Next", "Generate", or "Process".

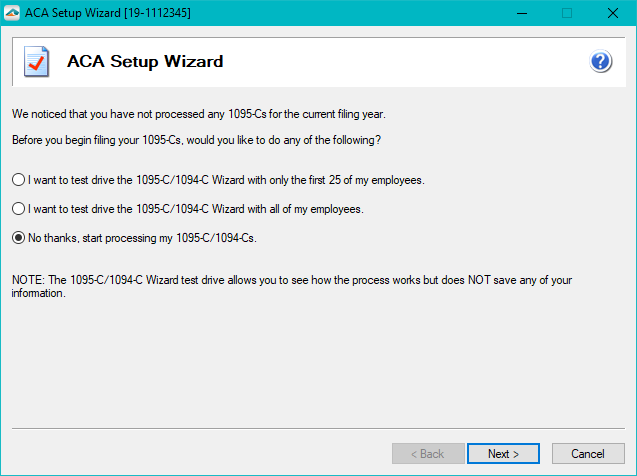

- Here the accounting/payroll software will push information over to the ACA Preparer. The beginning of the ACA process is the Company Setup:

- Choosing to test drive the process will let you get familiar with the ACA Preparer and functionality. However, no data changes will be saved for when you start processing the ACA forms.

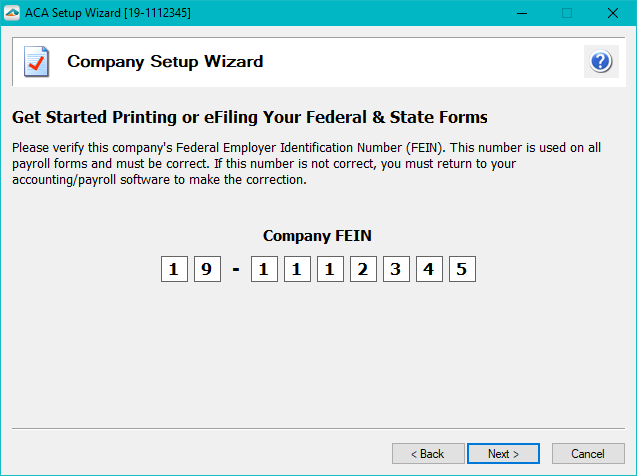

- The Federal Employer Identification Number (FEIN) will be on the second screen to display. This number is unable to be edited.

- If your FEIN is displaying incorrectly, please contact your accounting/payroll software.

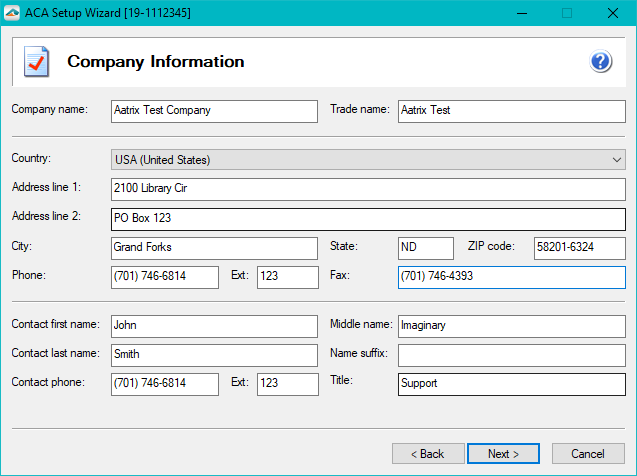

- Company Information must be present in order to continue through the process.

If this screen does not automatically populate with the company information, you are able to manually type in this information. Please note that the IRS will validate the EIN to the Company Name and reject the filing if this is not accurately reported. Check with the company's eServices account or with any official correspondence from the IRS.

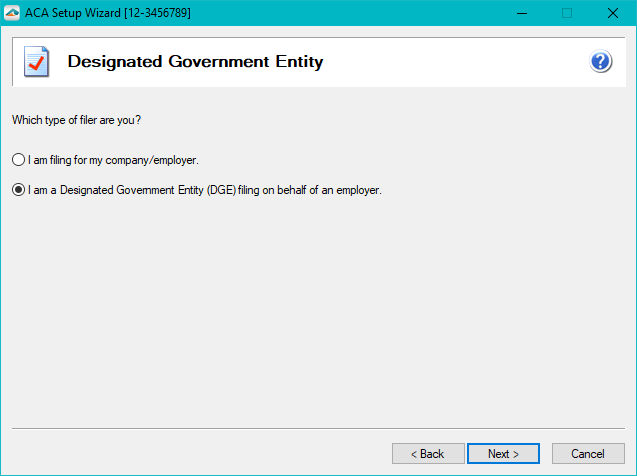

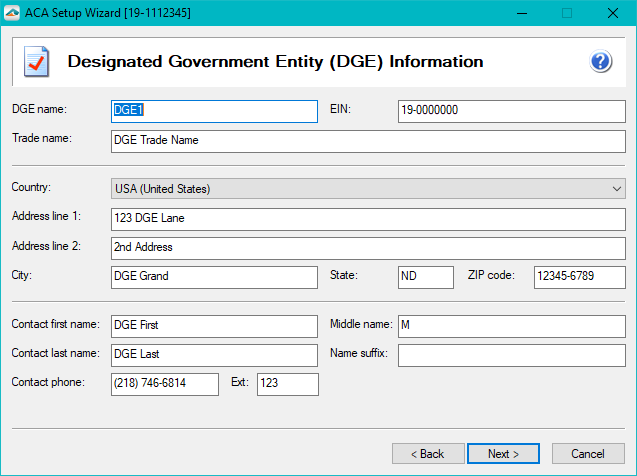

- Indicate if the company is a Designated Government Entity (DGE) filing on behalf of an employer. If this option does not apply to you then choose you are filing for my company/employer.

Note: If you are not a DGE, the next screen will not display to you.

- DGE Information must be present in order to continue through the process. If this screen does not automatically populate with the DGE information, you are able to manually type in this information.

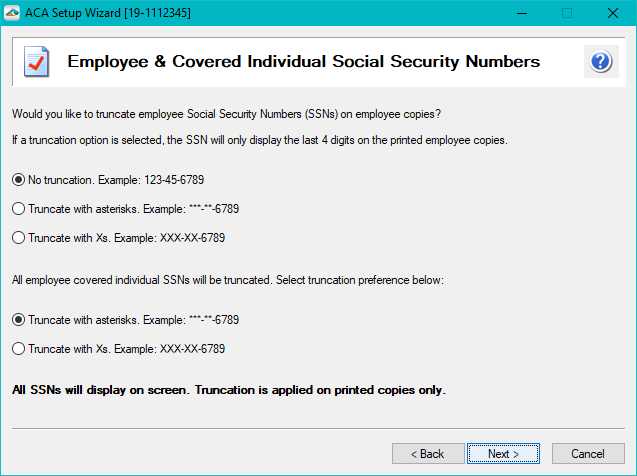

- The company may elect to truncate employees Social Security Numbers (SSNs) with asterisks

or Xs and can have no truncation on their SSNs.

or Xs and can have no truncation on their SSNs. - Covered Individuals are required to have their SSNs truncated with either asterisks

or Xs.

or Xs.

Note: The full SSNs will display on the screen. Truncation is only applied to the printed copies received by the employee.

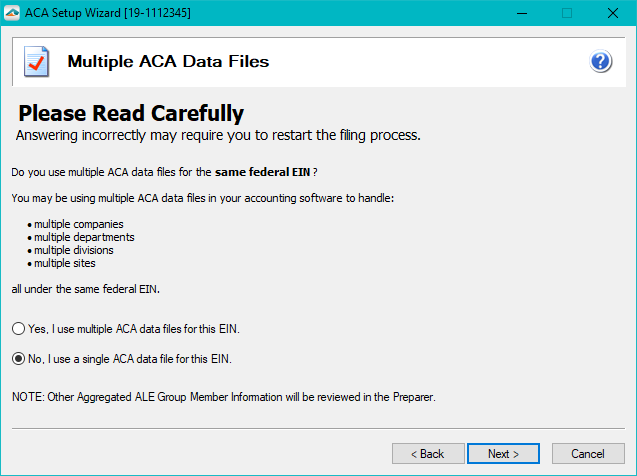

- If you have multiple databases for the same FEIN, a merge of databases must be completed. Aatrix does not allow multiple filings of the same form type for one EIN. Choose “Yes” and complete the merging process before proceeding. See Merging for more information.

If multiple databases does not apply to your company, keep the selection “No” and proceed to the ACA Preparer.

Once the Company Setup is completed, the ACA Preparer will open for you to review and process your information.

Note: If any information is not passed from your accounting/payroll software there is the capability to enter information manually or import a CSV file on a per column basis.

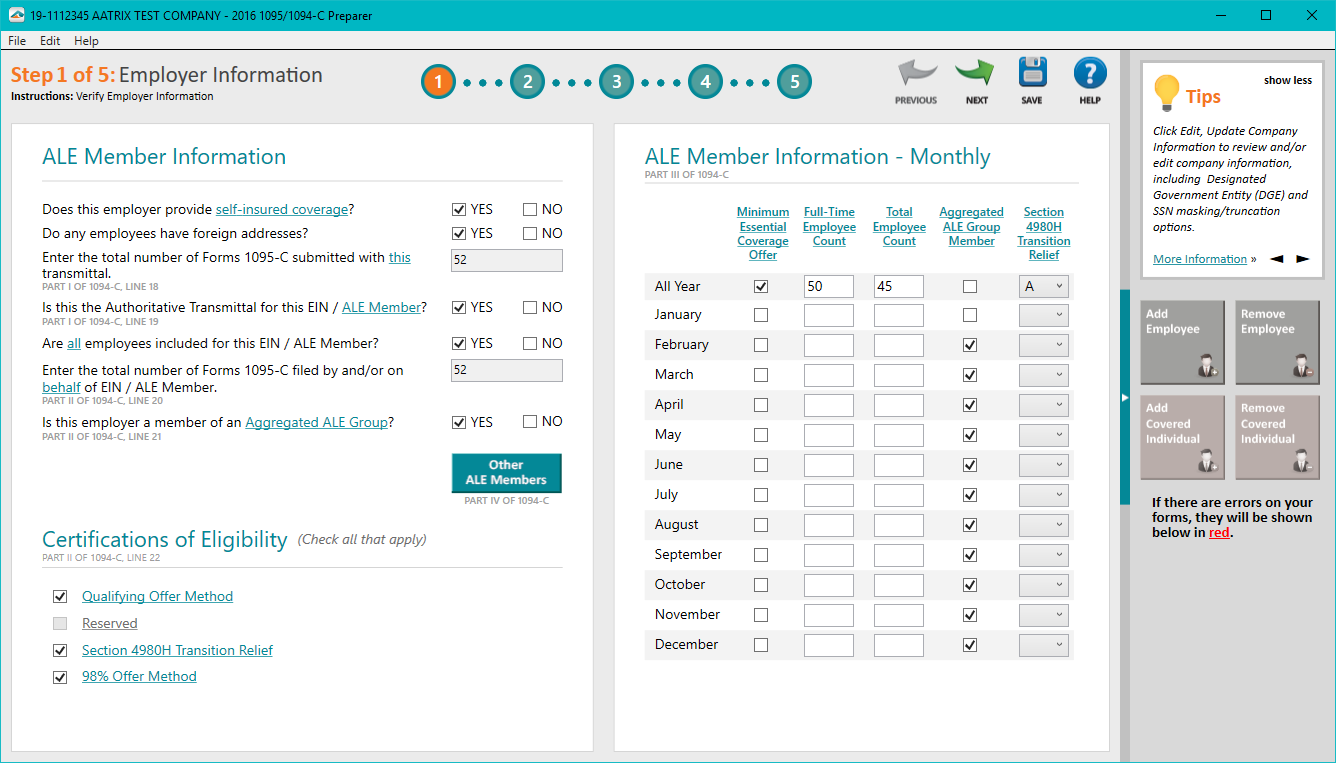

- Step 1

- Information will automatically be populated when entering into the ACA Preparer. If information is not present when entering into the Preparer you will be required to answer the questions and enter in information before continuing.

- Note: With the information passed from the accounting/payroll software the ACA Preparer will automatically populate this information. With this some of the questions about may be greyed out if passed from the accounting/payroll software.

- Information will automatically be populated when entering into the ACA Preparer. If information is not present when entering into the Preparer you will be required to answer the questions and enter in information before continuing.

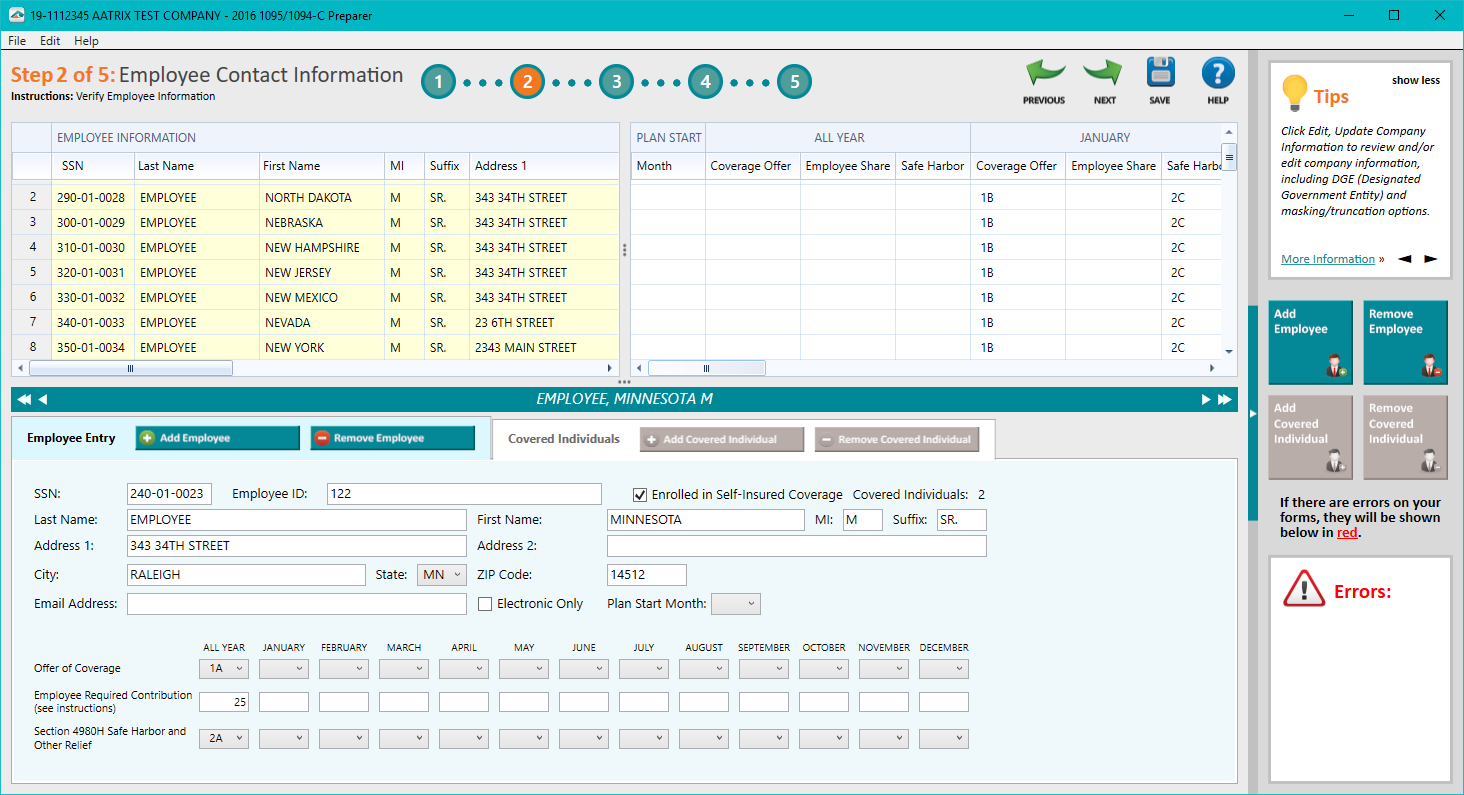

- Step 2

- Employee information will be validated during this step. To adjust any employee information, either change in one of the cells above or on the fields of the Employee Entry tab.

- Notes: Any errors will be displayed in the bottom right corner of the ACA Preparer. Hover over the red errors will provide you with additional help text details. Clicking on the error will bring the Preparer directly to that employee.

- Employee information will be validated during this step. To adjust any employee information, either change in one of the cells above or on the fields of the Employee Entry tab.

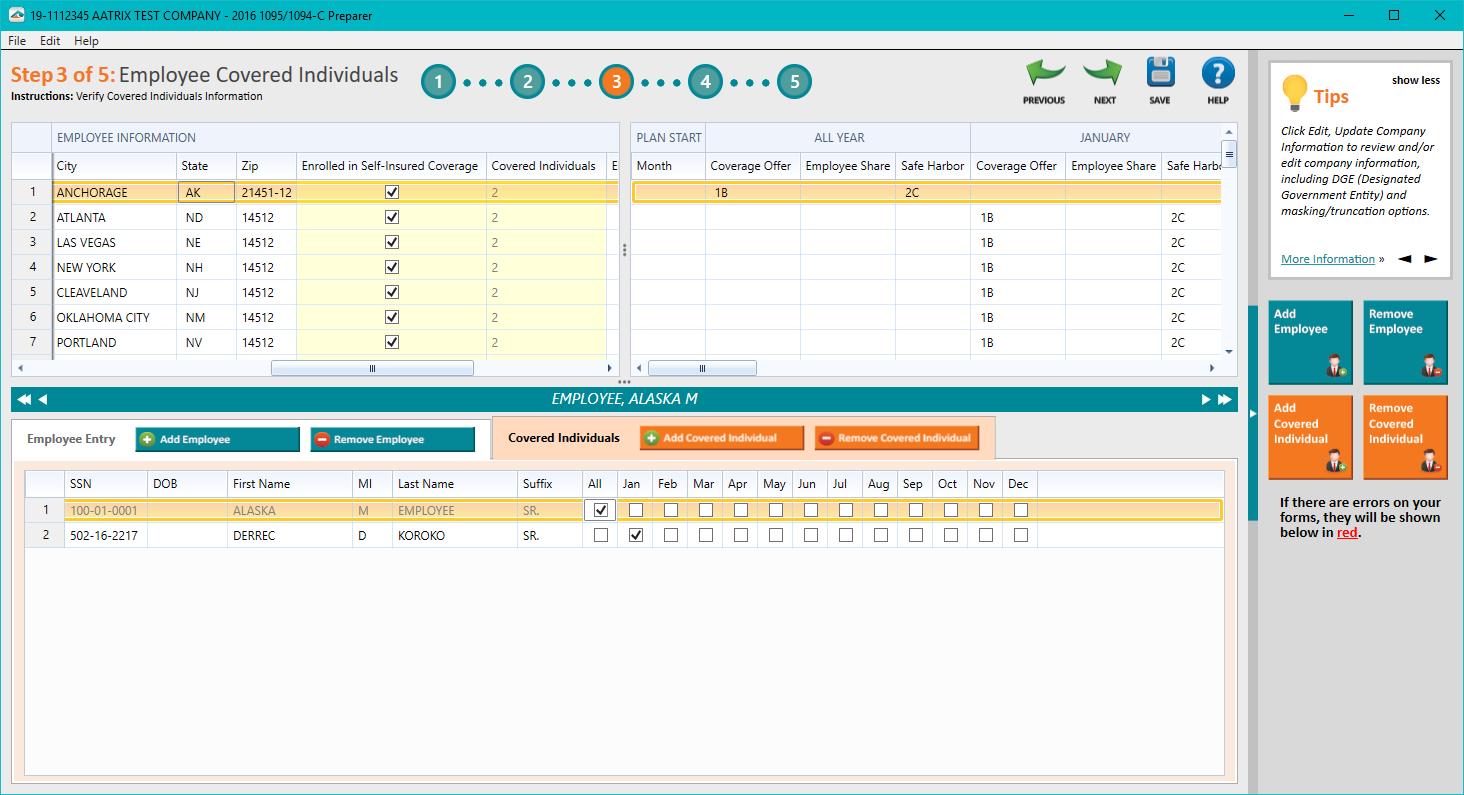

- Step 3

- Covered individual’s information will be validated (ei. SSN, Monthly coverage) during this step. To adjust any covered individual’s information click on the Covered Individual tab to make the adjustments.

- Notes: Any errors will be displayed in the bottom right corner of the ACA Preparer. Hover over the red errors will provide you with additional help text details. Clicking on the error will bring the Preparer directly to that covered individual.

- Covered individual’s information will be validated (ei. SSN, Monthly coverage) during this step. To adjust any covered individual’s information click on the Covered Individual tab to make the adjustments.

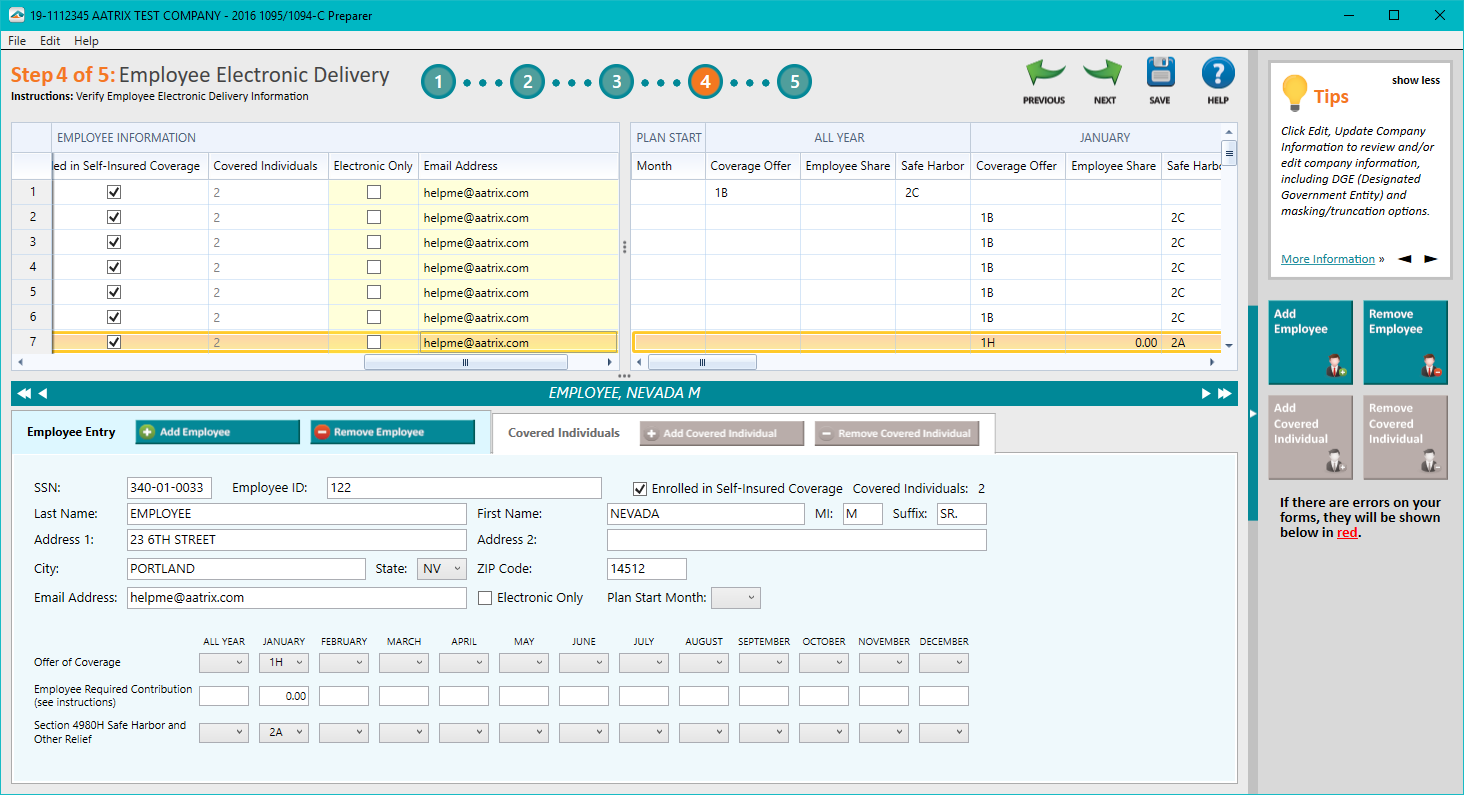

- Step 4

- This column indicates that the employee does not want a paper copy mailed to them. Only the electronic version will be marked for distribution online for employees to access. For more information on electronic access, see eW-2/e1095/e1099 Information. During this step, the Preparer will validate the format of the email addresses listed.

- Note: The ACA Preparer cannot validate if the email address provided from the employee is valid. Electronic only copies can only be utilized with the Complete ACA eFiling Service.

- This column indicates that the employee does not want a paper copy mailed to them. Only the electronic version will be marked for distribution online for employees to access. For more information on electronic access, see eW-2/e1095/e1099 Information. During this step, the Preparer will validate the format of the email addresses listed.

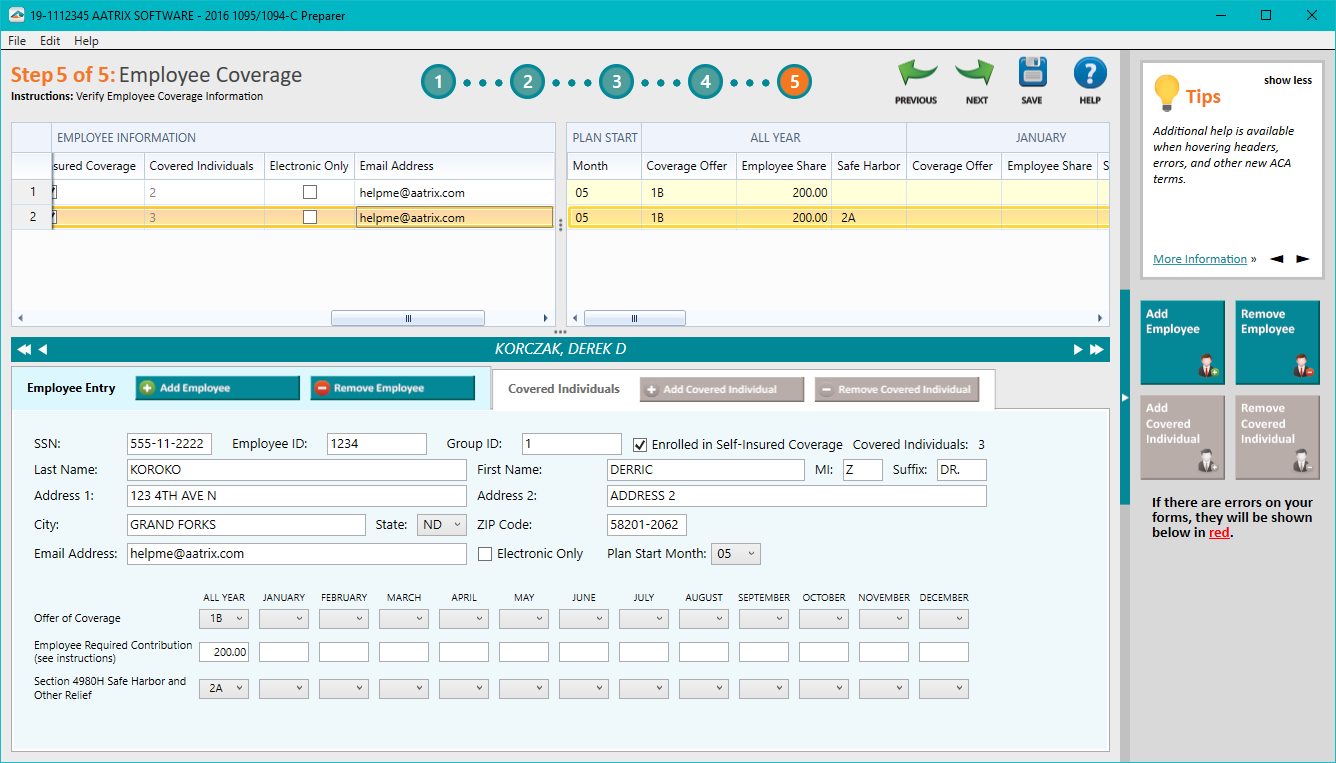

- Step 5

- During this step simple error checking will occur with the employee coverage information provided.

- Notes: Any errors will be displayed in the bottom right corner of the ACA Preparer. Hover over the red errors will provide you with additional help text details. Clicking on the error will bring the Preparer directly to that employee.

- During this step simple error checking will occur with the employee coverage information provided.

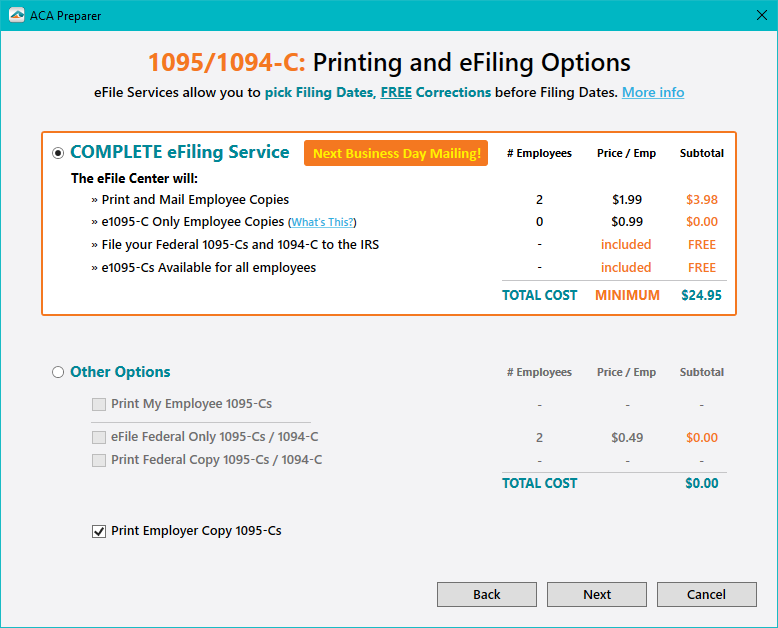

- Printing and eFiling options screen will allow you to pick and choose the options that best suits your company’s needs.

Complete eFiling Service:

- Aatrix will print and mail employees copies directly to the employee.

- Host electronic e1095s for all employees.

- Provide electronic only for selected employees (see Step 4).

- eFile the Federal copies to the IRS

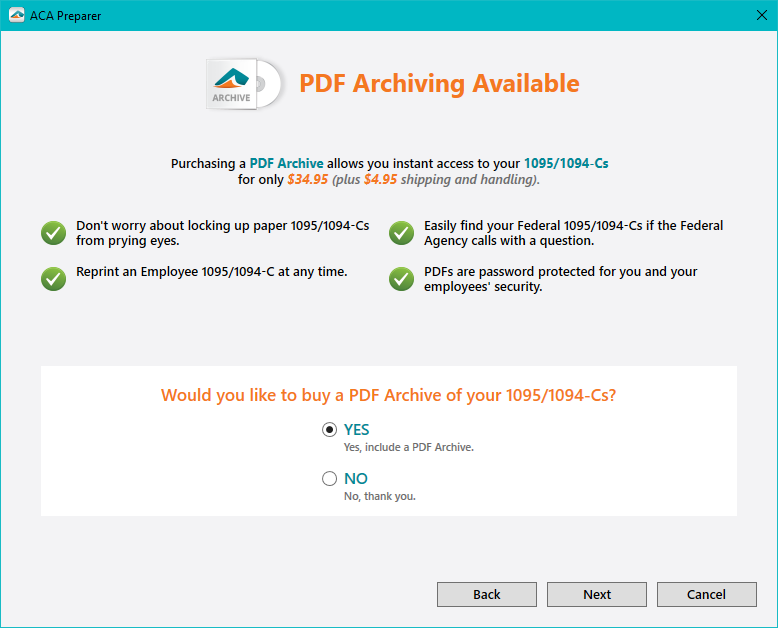

- Purchase a PDF Archive

PDF Archives are only able to be purchased during the eFile session if the Complete ACA eFiling Service was selected.

The PDF archive will be mailed directly to the company as a password protected USB drive with all copies of the filing that was submitted at the time of purchase.

Note: If corrections are made to the filing, a new PDF Archive is not automatically sent.

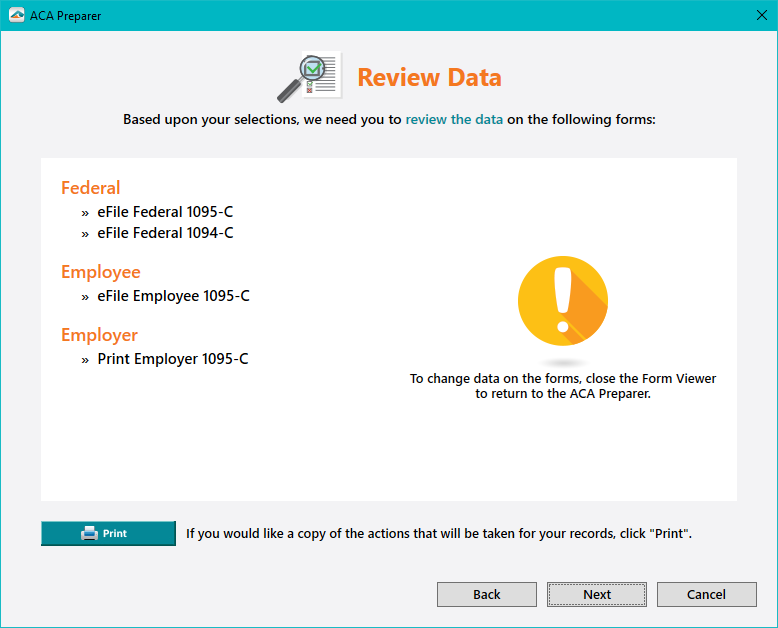

- The forms displayed on the Review Data screen will vary depending on the options selected previously for printing and eFiling.

The forms are listed in order they will display on in the Forms Viewer in the next step.

Based on the printing and eFiling options the forms will be preceded by “Print” or “eFile”.

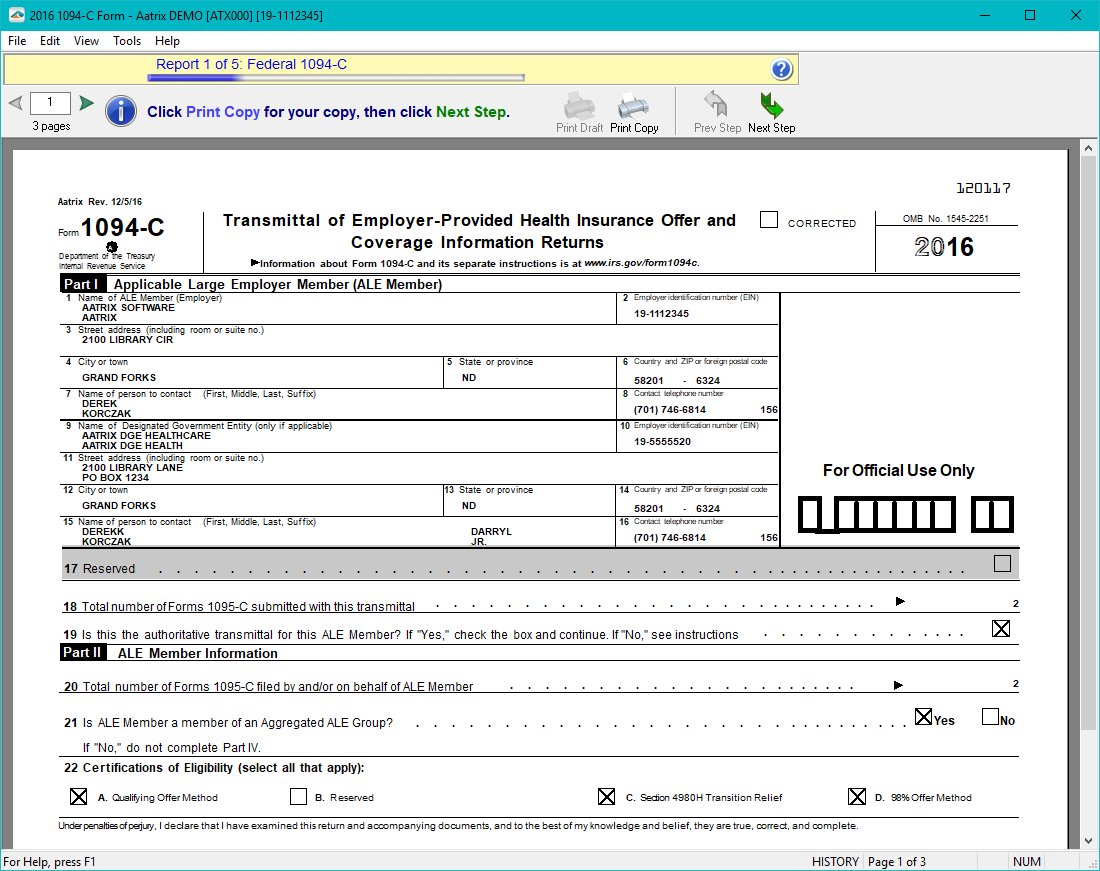

- Here the Forms Viewer will display the forms based on the previous selections.

The top report bar will show you how many reports will display, what report you’re on, and the report name.

Use the green arrows to switch to additional pages for the current report. Note: “Print Copy” will print the report with a “Records Copy” water mark. Selecting “Next Step” will prompt you to print a clean printed report unless it was selected to be electronically filed.

Note: “Print Copy” will print the report with a “Records Copy” water mark. Selecting “Next Step” will prompt you to print a clean printed report unless it was selected to be electronically filed.

- Once all reports have been reviewed and printed, the eFile Session will start up. If not previously enrolled the option to navigate to efile.aatrix.com will be available for enrolling. Once enrolling is completed please navigate back to the eFile Session screen and choose “I have enrolled and have my username and password”. Once logged into the eFile Session continue through the screens until an AFID (Aatrix Filing ID) number.

- When a filing is submitted an automatic confirmation email will be sent to the email address on file with Aatrix. The confirmation email will contain the filing details made during the ACA process.

- Once the eFile Session is closed the eACA Wizard will automatically begin if the Complete ACA eFiling Service was selected. Follow the screens to email or print off your employees access letters to access the e1095s.

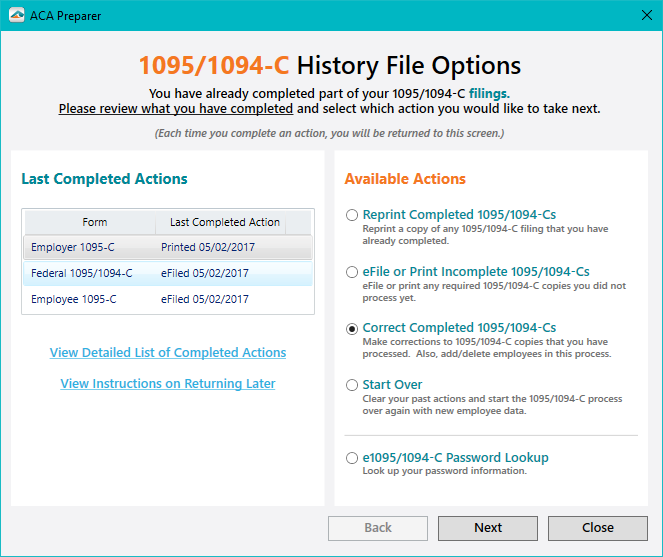

- The History File Options screen will display at the end of the ACA Process.

- See list of recently completed actions

- Note: If previous actions had been completed choose to “View Detailed List of Completed Actions”.

- View Instructions on how to return to the History File Options screen at a later time.

- Reprint already printed copies.

- eFile or print additional reports.

- Corrected an already completed eFile or printed filing.

- Start the ACA process over

- Note: This option is not always available.

- e1095/1094 password lookup, send e1095 emails, print access letters