Updating State Unemployment Rate

Your State Unemployment Rate is set by the state and is normally updated each year.

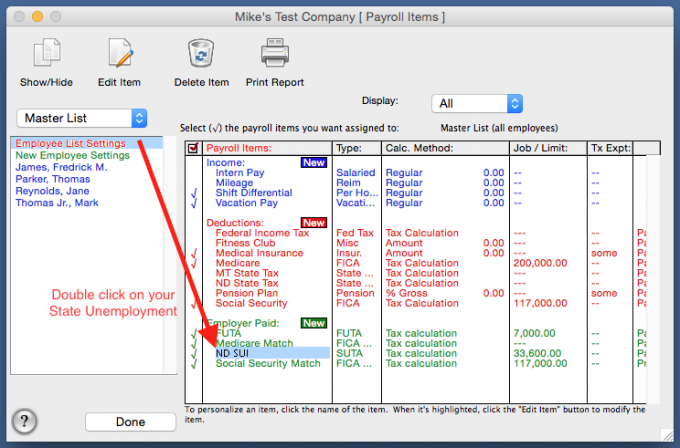

To update your State Unemployment Rate in the payroll program go to the Payroll Items screen.

- From the listing of your employees on the left side select "Employee List Settings" in red at the top.

- Double-click on your State Unemployment listed under the Employer Paid in green to the right.

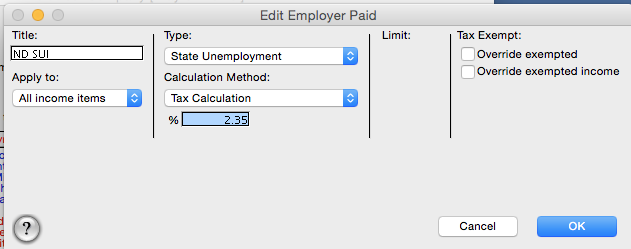

- Enter the rate for the company in percentage form.

Note: the rate needs to be entered as a percentage. If the State gives you the rate as a decimal, 0.0235 for example, then move the decimal point 2 places to the right, using the example you would enter 2.35

- Click "OK" and "OK" again to update the rate on future paychecks processed in the program.

Question: I processed payroll in the new year before receiving my new Unemployment rate. How do I make sure the rate is applied to those checks?

Answer: To have the unemployment rate applied to checks that have already been processed in your payroll program, follow the instructions below.

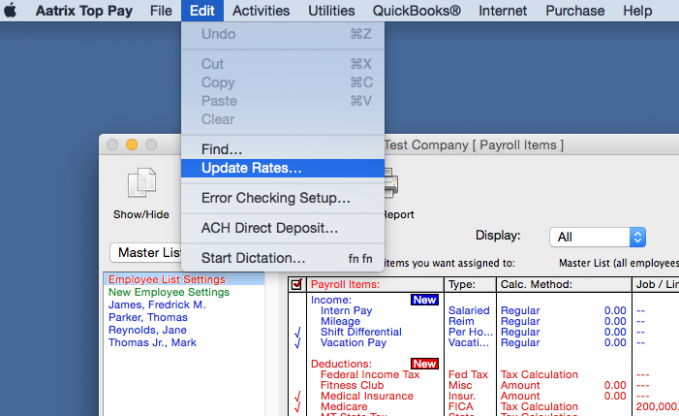

To update the rate on checks already entered into the program (updating retroactively):

- In Payroll Items, go to the "Edit" menu across the top of your monitor screen and select "Update Rates".

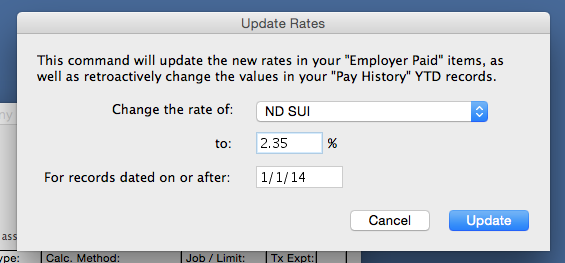

- From the "Change the Rate Of" dropdown menu, select your State Unemployment.

- Enter the rate for the company, again as a percentage, in the "To" box.

- In the "For Records Dated On Or After" select the effective date for the new rate.

- Make sure this is the First (1st) day of the year.

- Click "Update" and the program will go through the employee Pay History Records and recalculate the State Unemployment amount using the rate entered.

Related Pages:

Updating State Unemployment Wage Limit

FAQ: I have installed the year end update but my State Unemployment Wage Limit did not update. How do I update it?

Misplaced Registration Code (RegCode)

Read on what to do when you misplace your RegCode.

Checking for Updates

Learn when and how to check for updates.