Correcting "Error: EIN does not match the company in Quickbooks"

Question: When posting payroll I get a message "The EIN does not match the company in Quickbooks". How do I fix that so I can post my payroll?

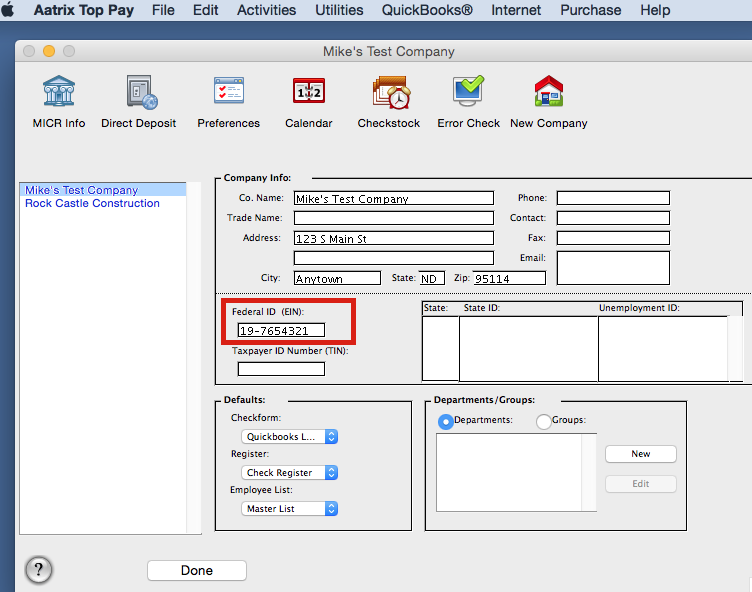

Answer: For your payroll to post to Quickbooks the Federal EIN entered in both programs needs to be exactly the same.

- In your Quickbooks program, delete your Federal EIN and reenter it.

- In your Payroll program, go to the Company Information window, delete the Federal EIN and reenter it.

- Go to the "File" menu and select "Save".

- Click "OK".

- Quit out of both programs and reopen them.

- Post your payroll to Quickbooks.

Related Pages:

Correcting "Error: Your Tax Table Registration Code is expired or invalid."

FAQ: How do I correct the error, "Your Tax Table Registration Code is expired or invalid" after entering new code?

Correcting "Error: Forms Engine Failure Error" on OS Sierra

FAQ: How do I correct the error, "Forms Engine Failure" on OS Sierra?

Correcting "Error: The application may be damaged."

FAQ: How do I correct the error, "The application may be damaged when opening after installing program on new computer."?

Correcting "Error: Please Locate Quickbooks" when posting Payroll

FAQ: When I post my payroll a box opens up asking me to "Please Locate Quickbooks". What do I do?

Correcting "Error: Company Information is invalid."

FAQ: How do I correct the error, "Company Information is invalid." when processing Print & Mail reports?