eW-2/e1095/e1099 Consent Form

Last modified by Derek K on 2024/02/07 22:29

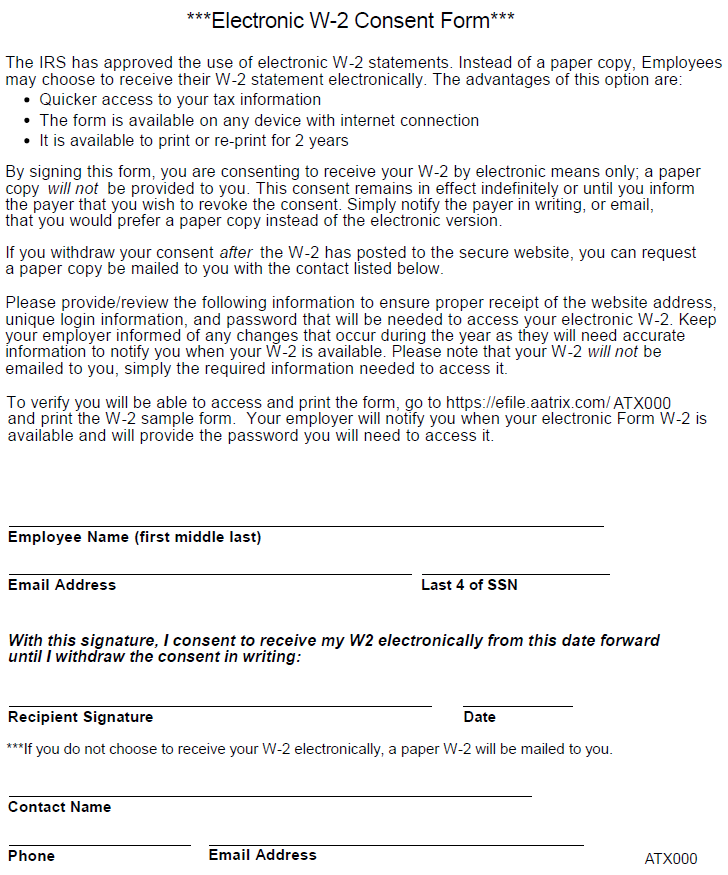

The Electronic W-2 or 1099 Consent Form

The employer is required to have the employee or recipient agree to have only an electronic W-2 or 1099, instead of receiving a paper W-2 or 1099. This consent form is documentation for the business in case a complaint is filed with the IRS.

Note: That an employee/recipient can receive a paper copy and an electronic eW-2/e1099 when filing with our Complete service. If the employee/recipient receives both types of forms, the Consent form is not needed. The consent by the employee/recipient must be made electronically in a way that shows that they can access the statement in the electronic format in which it was furnished.