Invalid SSN Error in the W-2 Preparer

Last modified by andrew k on 2026/01/27 20:42

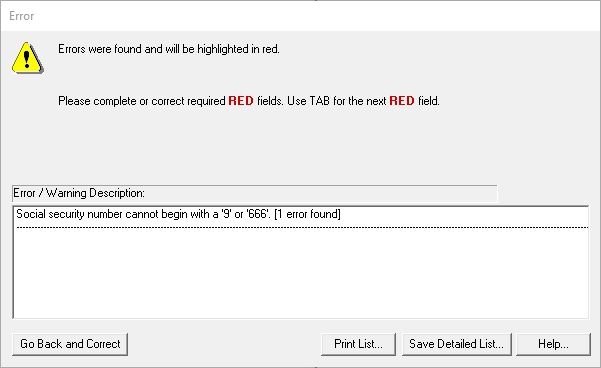

Aatrix cannot process W-2s with an invalid SSN (Social Security Number) and will display the following error.

If an employee has a nine-digit number, formatted like an SSN, that starts with the number 9 and has a range of numbers from 50-65, 70-88, 90-92, and 94-99 for the fourth and fifth digit, that number is called an ITIN (Individual Taxpayer Identification Number). (i.e. 9NN-7N-NNNN). Do not use an ITIN in place of an SSN on Form W-2.

To proceed with these individuals in the W2 Preparer, zeros (000-00-0000) must be used in the SSN field. Once the employee receives their SSN, the employer must file Form W-2c with the corrected information.

Here is documentation from the SSA on ITINs:

IRS issues ITIN's to individuals who are required to have a U.S. Taxpayer Identification Number, but who do not have, and are not eligible to obtain, a Social Security Number (SSN) from the Social Security Administration (SSA).ITINs are issued regardless of immigration status because both resident and nonresident aliens may have a U.S. tax return and payment responsibilities under the Internal Revenue Code.Individuals must have a filing requirement and file a valid federal income tax return to receive an ITIN, unless they meet an exception.

If a person is eligible to work in the United States, even if they are not a citizen, they can apply for and receive an SSN. It is the employer's responsibility to verify that all the people they have hired are eligible to work in the United States, and that means that an employee must have a valid SSN.

IRS Informational Guides:

If you would like information on employee hiring, here is a link to the IRS website: Small-Businesses-&-Self-Employed/Hiring-Employees

For the W-2 instructions on SSN/ITIN reporting, please view page 14 of the IRS publication: General Instructions for Forms W-2 and W-3

For additional information on ITINs and W-2s, please view page 14 of this IRS publication: (Circular E), Employer's Tax Guide

For additional information on ITINs, here is a link to the IRS website: How-to-File/Individual Taxpayer Identification Number

Additional Information: