Attaching the Schedule B

Last modified by Derek K on 2024/02/07 22:29

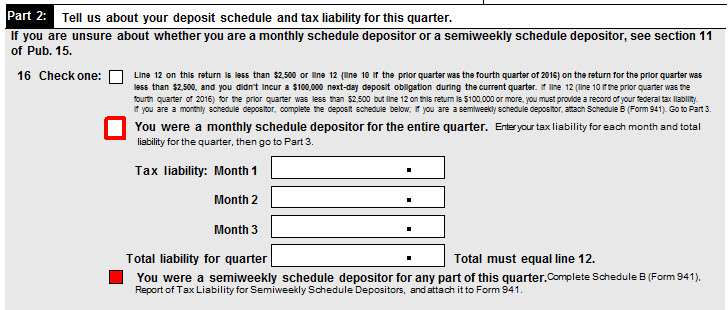

On page 2, part 2, of the 941 Form there are three options:

Option 1: Line 12 on this return is less than $2,500 or line 12 on the return for the prior quarter was less than $2,500, and you did not incur a $100,000 next-day deposit obligation during the current quarter.

Option 2: You were a monthly schedule depositor for the entire quarter.

Option 3: You were a semiweekly schedule depositor for any part of this quarter.