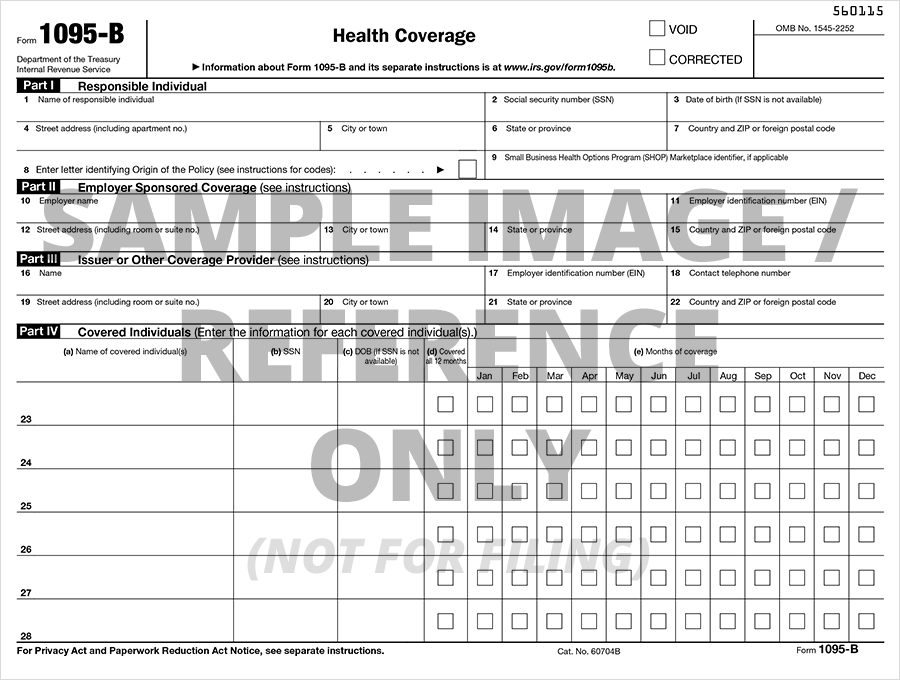

IRS FORM 1095-B

Version 4.1 by jackb on 2023/11/02 21:08

FORM 1095-B

Click on the individual boxes below for specific IRS Instructions

| Part II: Employer-Sponsored Coverage |

| Lines 10-15, Name, EIN, and Complete Mailing Address for the Employer Sponsoring the Coverage |

| Part III: Issuer or Other Coverage Provider |

| Lines 16-22, Name, EIN, and Complete Mailing Address of Issuer/ Other Coverage |

| Part IV: Covered Individuals |

| Column (a), Covered Individual's Name |

| Column (b), Covered Individual's Social Security Number (SSN) |

| Column (c), Covered Individual's Birthdate (MM/DD/YYY) if Social Security Number (SSN) is not available |

| Column (d), Covered all 12 months |

| Column (e), Months of Coverage |

| Part IV: Covered Individuals (Continuation) |

| Column (a), Name of each Covered Individual |

| Column (b), Social Security Number (SSN) of each Covered Individual |

| Column (c), Birthdate (MM/DD/YYY) of each Covered Individual if SSN is not available |

| Column (d), Individual Covered for 12 months |

| Column (e), Coverage each month if individual wasn't covered for all 12 months |

Related Pages:

IRS Forms 1095-C

Learn more about the IRS Form 1095-C

IRS Forms 1094-C

Learn more about the IRS Form 1094-C

IRS Forms 1094-B

Learn more about the IRS Form 1094-B