T4/T5018 Corrections

If a filing has been submitted and an error has been found, re-open the T4/T5018 Preparer from the accounting software by following the steps below.

- First, access the "History" of the filing to process any corrections; this can be done one of two ways.

- Option 1: To access the history for T4/T5018s, select the report from the Form Selection window.

- Option 2: You may also choose the existing reports or form type "History". Then select "OK", "Accept", "Next", "Generate", or "Process"

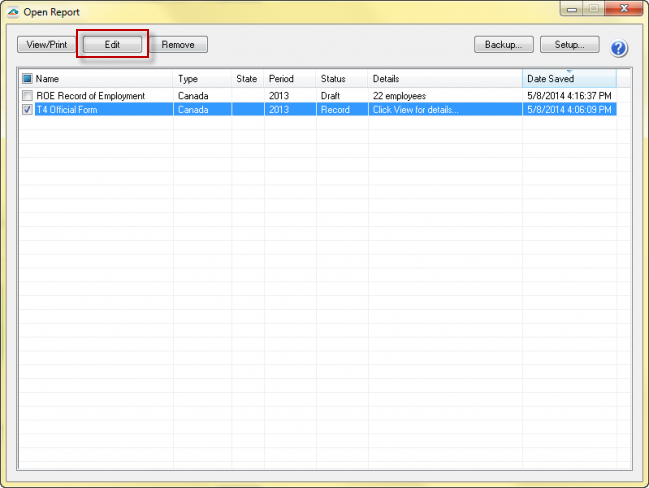

The Open Reports window will appear. Here, select the Record Copy of the T4/T5018 filing for the appropriate year. You will see the status of "Record" under the Status column. Once the Record copy is selected, choose to "Edit" the report.

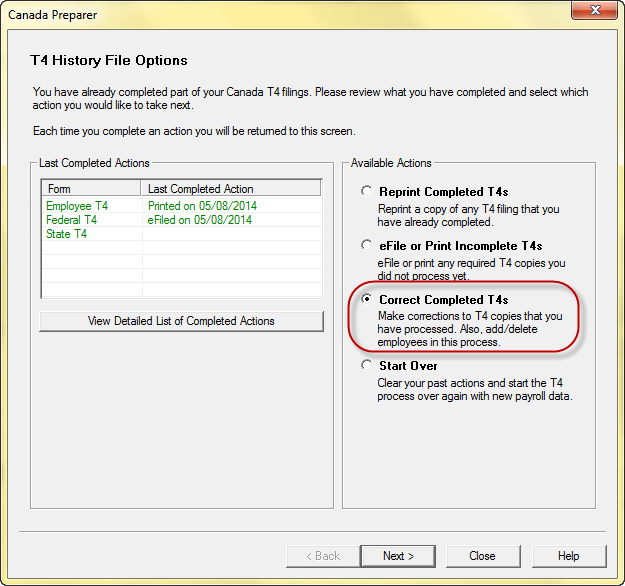

- Once at the History File Options dashboard, you will see a radio button beside the option, "Correct Completed".

Choose this option and then click "Next".

- The Preparer will display. Here you can change the employee/recipient information. Any data you change will cause the cell values to turn blue and the far left row number of the employee's name will turn green.

Note: All the same error checking performed in the Preparer applies again just as the first time around.

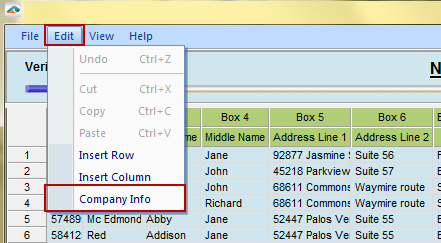

- To change any company information, like account numbers, go to the "Edit" menu located in the top left corner and choose "Company Info". Once any changes are made, click "Next" until the company setup closes.

For additional information:

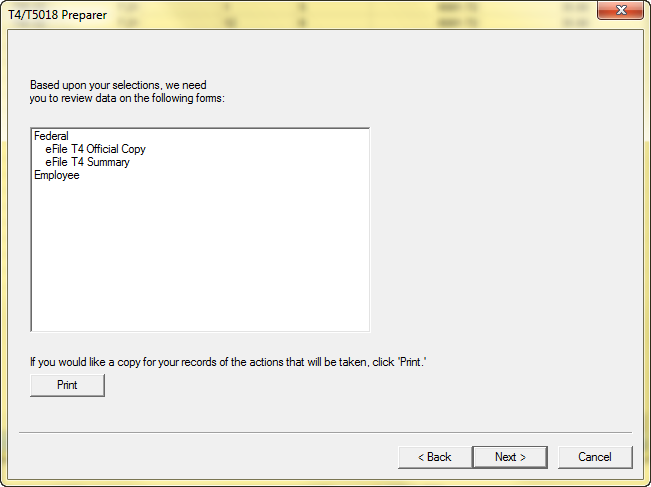

- When you have completed all changes and click "Next Step", the action list will appear.

The action list is created based upon the type of T4/T5018 copies previously completed, what you changed in the Preparer and T4/T5018 filing wizard, and the current status of the eFiling. All this information is compiled through the software to determine what forms need to be completed for the corrections made.

- After the action list, the Forms Viewer populates. The forms will begin to display in the same order as on the action list.

Note: Depending on what has and hasn't been processed, it will determine the forms to display.

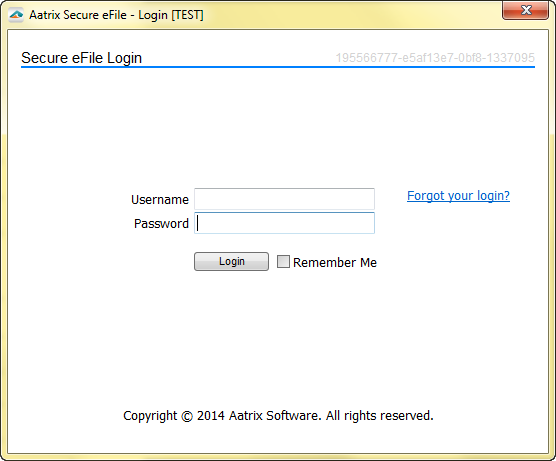

- After the Forms Viewer, the eFile wizard will appear.

Enter the username and password to eFile and submit the corrections.

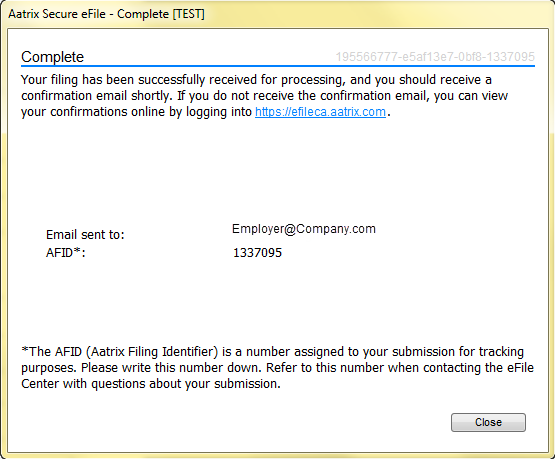

- There will be a new AFID for the corrections.

Note: If the eFile Center has not submitted the filing to the agency, there is no charge to send a replacement filing. If the filing has been submitted, there is a charge per corrected employee only.

Related Pages:

Saving and History

Learn how to save your work in progress and access your history.