Correcting "Error: State Wages are greater than State Withholding"

Last modified by Peytience S on 2023/11/01 21:07

Question: How do I correct "Error: State Wages are greater than State Withholding" when processing W-2's?

Answer: Follow the instructions below.

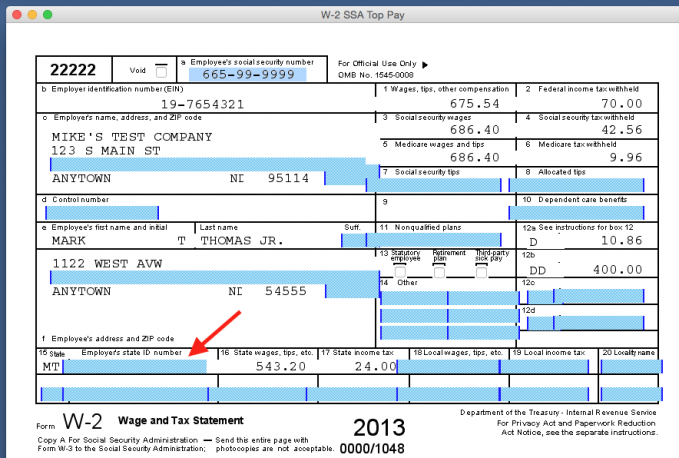

- Look at Box 15 and see if there is an Employer State ID Number.

- If it is blank, it will need to be entered into the program. Once entered, it will automatically fill in when processing your forms.

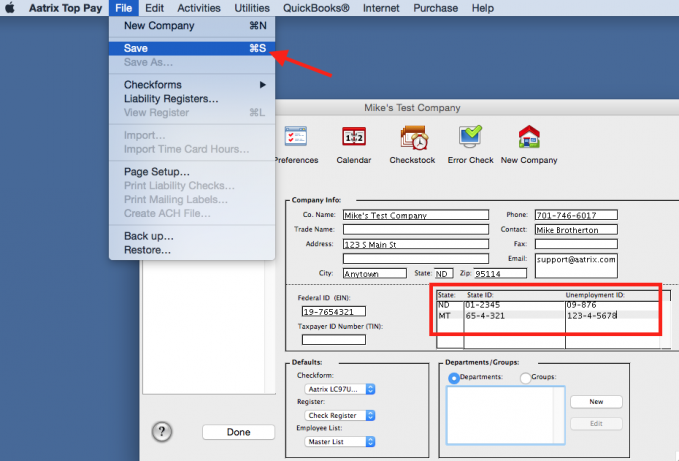

- To enter your Employer State ID into the payroll program, quit out of the Form Viewer.

- In your payroll program, go to the Company Information screen.

- Below the Company Info, enter your State 2-letter Abbreviation using capital letters in the State column in the box to the right.

- Enter the Employer State ID for withholding in the "State ID" column.

- If you know your State Unemployment ID, you can enter it under the "Unemployment ID" column.

- Go to the "File" menu and select "Save", then click "OK".

- Reprocess your W-2's and verify that Box 15 now has the State ID entered.

Related Pages:

Printing W-2's without "Records Copy"

FAQ: How do I print the W-2's without "Records Copy" across them?

Reporting Local Taxes on W-2's

Learn about how to report local taxes on W-2's.

W-2 Processing and Printing Guide

Read our guides in updating, processing, printing your W-2's.

W-2 eFile Pricing

Read more about W-2 eFile pricing for Aatrix Payroll Reports.

Reprinting W-2's

FAQ: If I print my own and an employee needed a copy of their W-2, can I reprint it?