Employee/Recipient Email Address Information

Last modified by andrew k on 2026/01/27 20:42

To indicate you have employees or recipients that wish to receive an eW-2/e1099 only and not receive a paper copy, here are some things to note.

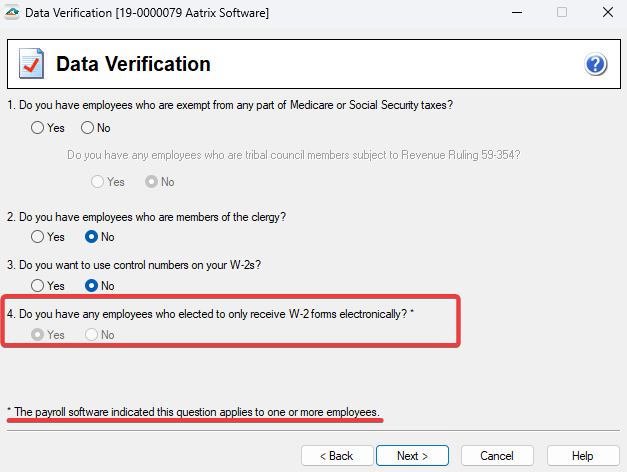

To indicate that you do have employees/recipients that are going to receive an electronic W-2/1099 only, you must select this option in the "Company Setup", here is a screen shot of the W-2 and 1099 options.

Note: This option automatically defaults to “No”, it must be manually changed if “Yes”.

- If your payroll software allows you to enter in your employee/recipient email address, when that information gets passed to us, we will automatically check the "Yes" option and grey out the box.

Once you have completed the "Company Setup", you will then enter into the Preparer.*

Here you will have to make sure an email address is entered and the "Electronic Only" column has the appropriate check boxes checked.

To enter in an email address manually, you simply select the email address box in the appropriate row of the employee/recipient and enter it in.

The eW-2/e1099 option is only available when choosing the complete option. The complete option includes the following services:

Printing and mailing of employee/recipient copies

eW-2/e1099 copies

eFiling of state copies

eFiling of federal copies

eFiling of supported localities

Note: If you are not sure if your payroll software allows you to enter in employee/recipient email addresses, please contact their support department for more information.