Electronic Access for W-2s/1099s (WEB) Process

Electronic Access for W-2s/1099s

After completing a W2 or 1099 MISC/NEC Filing, the employer/payer will see the Electronic Access for W-2s/1099s. Please note that this option will be greyed out until the Filing has fully completed processing; it will NOT be available immediately after filing.

You can access this Dashboard through your software History. Once the filing has completed processing, the Electronic Access For W-2s/1099s button will become available, typically within one hour after filing.

After you click Electronic Access For W-2s/1099s, you will see the employees/recipients list.

- Select individuals

- Select only those who opted in (yellow)

- Select those that didn’t opt-in (must include a valid email address)

- You can update/change email addresses from this screen.

- You must click “save changes” to update the information.

- You can update/change email addresses from this screen.

When you have made your selections, click Email Access Letters

You will see a message display once the emails have been successfully sent.

Accessing Emails

Employees/Recipients will receive emails at the address specified on the electronic access screen. Access is available from the Link in the email labeled "HERE".

Please note that the employee will register using this link with their email as their username (where they received the email) and SSN/TIN as their password.

After signing in, the employee/recipient will receive another email with an access code for additional security. This access code is a one-time use code. A new code will be sent with each login attempt. Enter the code and hit submit to access the website where the electronic tax forms are available.

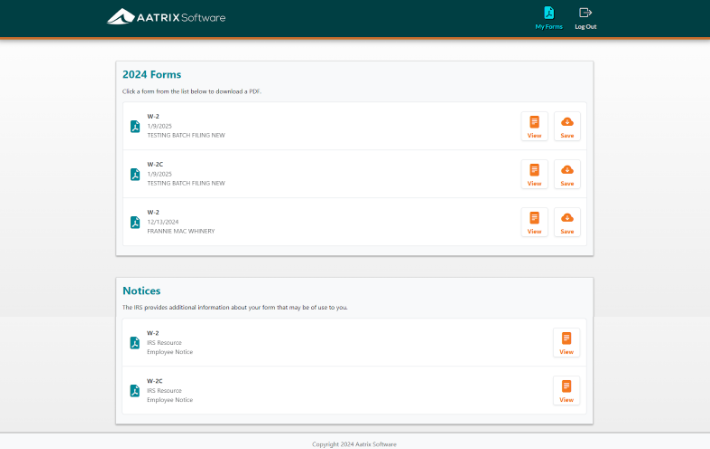

All forms will be viewable for an Employee/Recipient by form and year after successfully logging in.