Correcting a State W2 Reconciliation Form

Last modified by andrew k on 2026/01/27 20:42

If a State Reconciliation Form has been submitted with an error, re-open the W-2/1099 Preparer from the accounting software by following the steps below:

- First, access the history of the filing to process any corrections; this can be done one of two (2) ways:

- To access the history for W-2s/1099s, (1) Select the report from the "Form Selection" window.

- Or (2) Choose the existing reports or form type "History".

- Select "OK", "Accept", "Next", "Generate", or "Process".

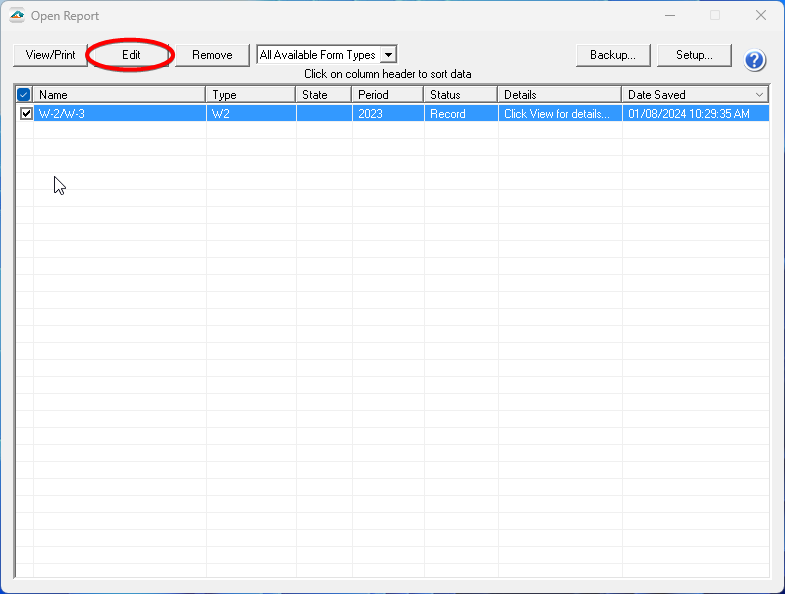

- The "Open Reports" window will appear. Here, select the Record Copy of the W-2/W-3 or 1099 filing for the appropriate year.

- You will see the status of "Record" under the "Status" column.

- Once the Record Copy is selected, choose to "Edit".

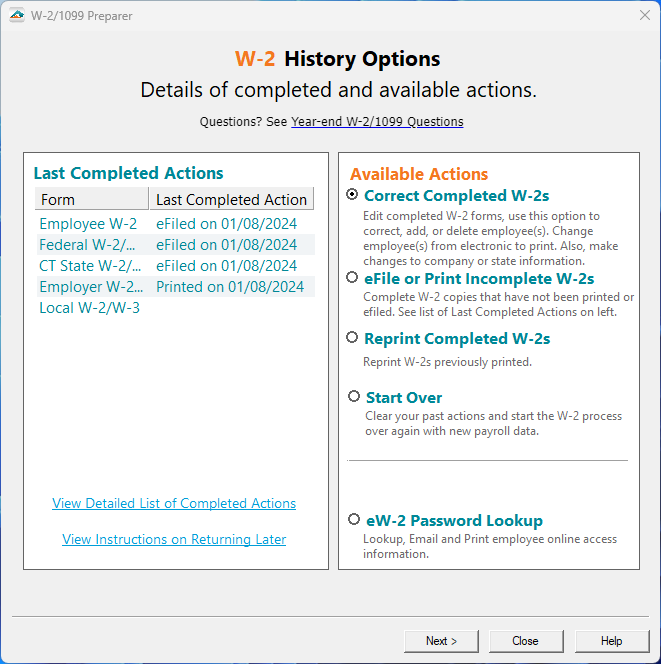

Once at the "History File Options" dashboard, you will see a radio button next to the option "Correct Completed". Choose this option and then click "Next".

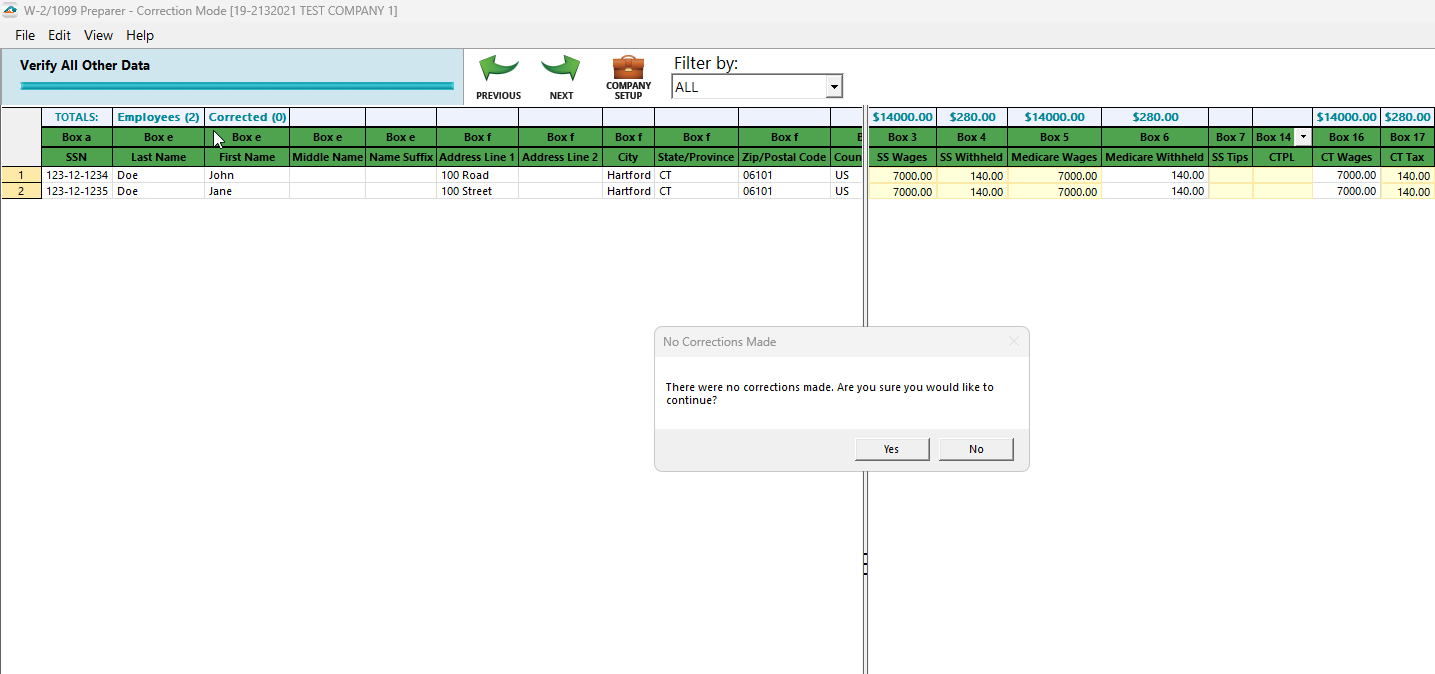

The W-2/1099 Preparer will display. Here, you will want to click "Next" through the grid. You will then see the following message. Select "Yes"

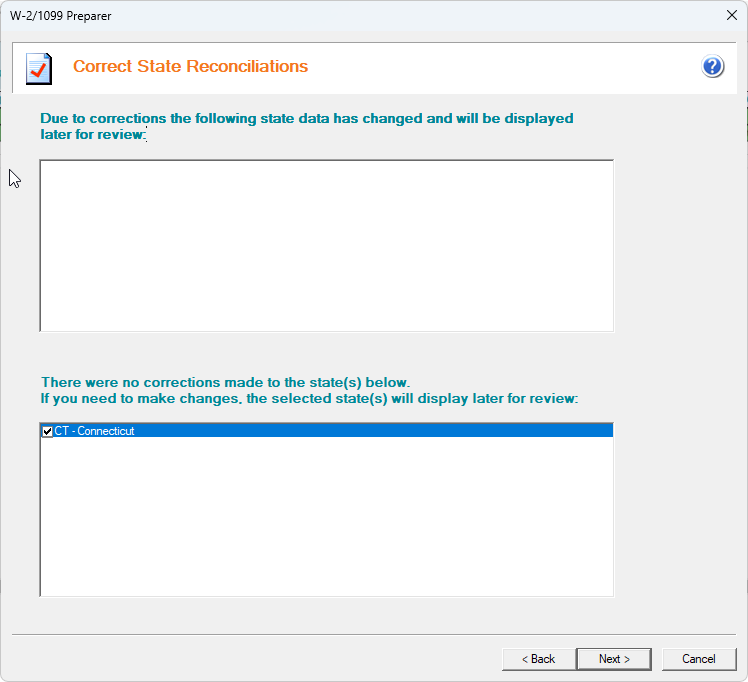

After proceeding, you will see a "Correct State Reconciliations" screen where you can select the particular State to correct.

This will then display the State Form to be edited and resubmitted.