NJ Wage and Tax Formats

Last modified by andrew k on 2026/01/27 20:42

The state of New Jersey has specific formats for W-2 Wage and Tax Statements, regarding the proper reporting of Unemployment Insurance, Workforce Development/Supplemental Workforce Fund, New Jersey Disability Insurance, and Family Leave Insurance.

New Jersey requires specific names for their additional state taxes.

FLI = Family Leave Insurance (state or private plan)

SDI = State Disability Insurance (state or private plan)

UI/WF/SWF = Unemployment Insurance/Workforce Development Partnership Fund/Supplemental Workforce Fund

NJPFLI = NJ Private Family Leave Insurance (Reported on the W-2s as FLIPP)

NJPDI = NJ Private Disability Insurance (Reported on the W-2s as DIPP)

There are different acceptable means to report these taxes on W-2s. The following examples will show how these tax items will show on the Aatrix W-2 Forms.

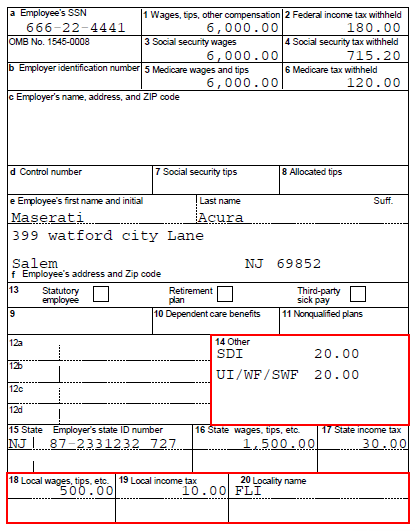

Here is an example of a W-2 for an employee that contributes to the standard SDI and FLI plans, as well as UI/WF/SWF.

The SDI and UI/WF/SWF information will appear in Box 14.

The FLI information will appear in Box 18, Box 19 (amount), and Box 20(name).

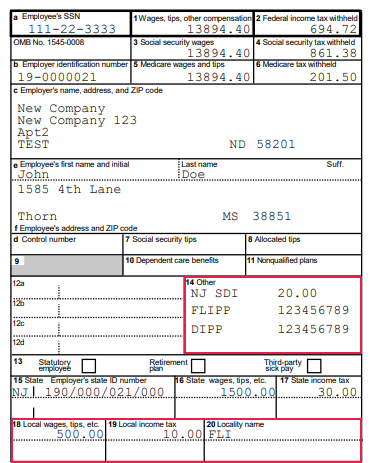

Here is an example of a W-2 for an employee that contributes to Private SDI and FLI plans, as well as the state UI/WF/SWF plans:

Both of the Private Plan account numbers will appear in Box 14.

The SDI, UI/WF/SWF amounts will appear in Box 14.

The FLI amounts will appear in Box 18, Box 19 (amount) and Box 20 (name).

Since Box 14 only allows for 3 items, this employee will have two (2) W-2s to account for all the information needed for Box 14.

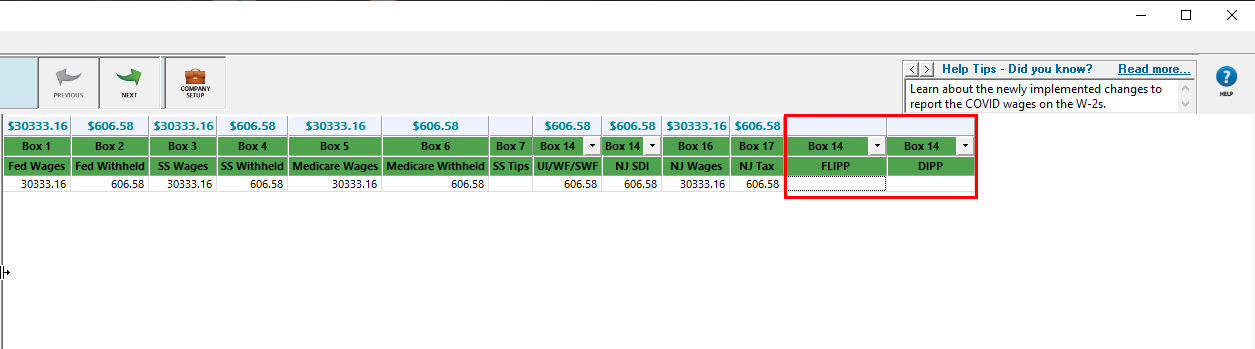

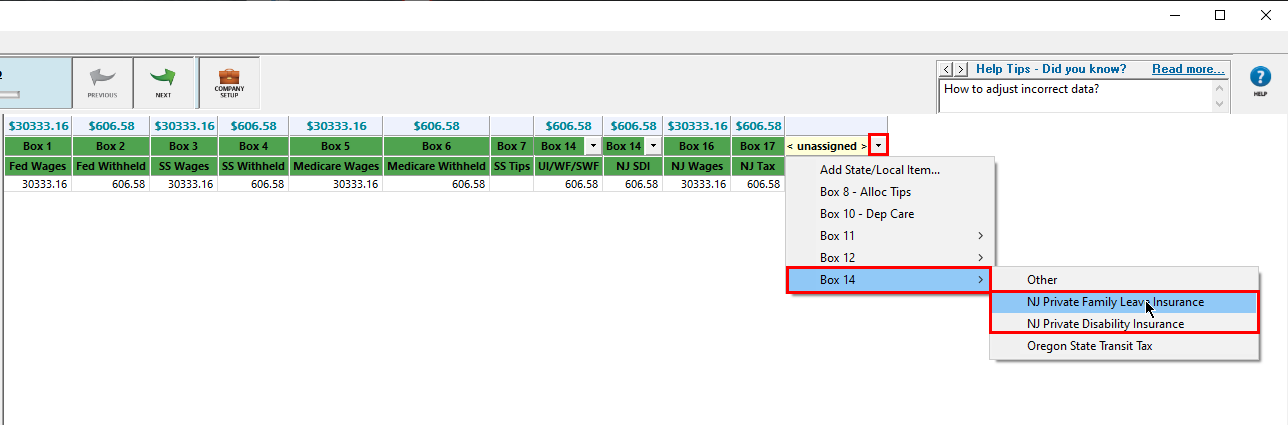

Here is an example of how to correctly assign private plan information for SDI or FLI to Box 14 on the W-2 forms:

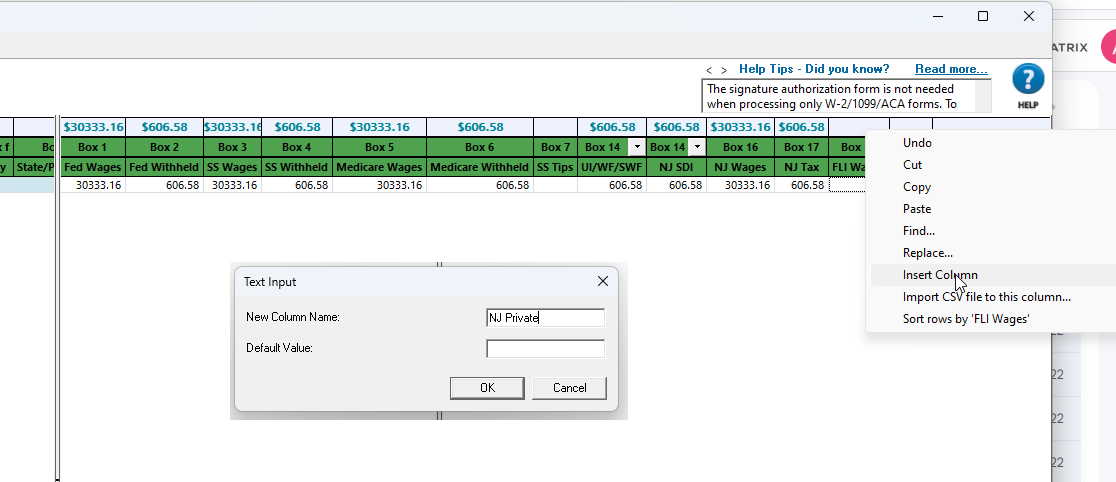

Start by right-clicking anywhere in the green section and selecting Insert Column. There will then be a prompt for a New Column Name and Default value. The Column name will be used to differentiate unassigned columns. Any name can be inputted at this point since it will be replaced by the linked column name after the type of box is selected.

Next, click on the drop-down arrow and select the box 14 option to see the NJ options.

Note: To see these NJ options, New Jersey Withholding must be set up in the Company setup.

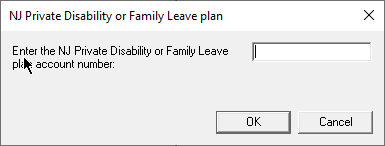

There will then be a prompt to enter the account number.

Note: The account number will only appear on the W-2 Form if there is a dollar amount in the FLIPP or DIPP column for that particular employee.

The final column will then display for editing.