About 94X Series Signatures

Aatrix has added an enhancement to the eFile process: 94x Series Signatures

To maintain compliance with the Federal Modernized eFile system, when eFiling a Federal 94x series form, a signature method for the Form 8453-EMP will display. This process replaces the application for a 94x 10-digit Signature PIN.

- To start, only the following forms will prompt for a signature method; additional form sets may be added in the future.

Federal 94x Series Forms:

- 940 Report

- 941/Schedule B/941-V Report

- 941-X Report (No Electronic Signature Needed)

- 943/943-A/943-V Report

- 944 Report

- 945/945-A/945-V Report

- After the eFile button is selected:

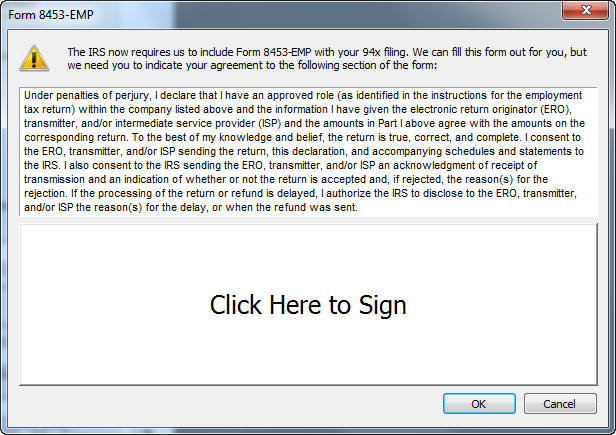

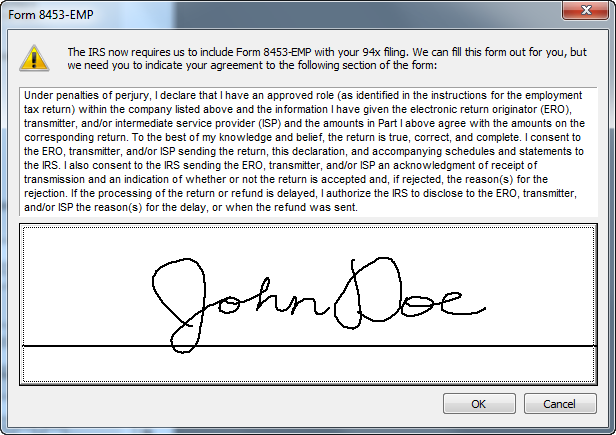

- The Form 8453-EMP window displays. After reading through the 8453-EMP agreement, add a new signature, select an existing signature, or select reporting agent by clicking the Click Here to Sign area.

- The Cancel button will return to the form.

- OK will prompt for a signature method.

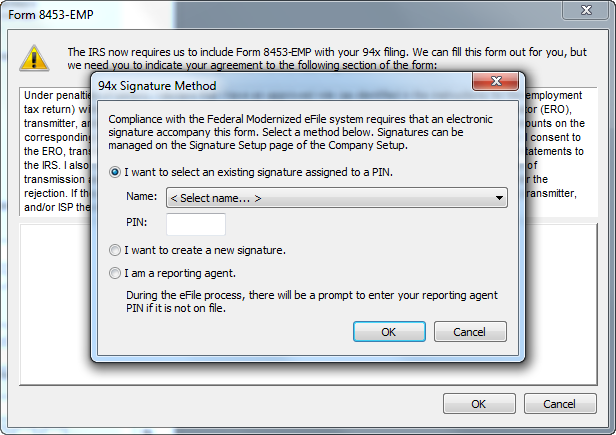

- The 94x Signature Method window will appear. Select one of the signature methods:

- I want to select an existing signature assigned to a PIN. – This option will be disabled if there are no signatures available. If a signature is saved, it can be chosen from the drop-down list, which will then require the PIN for the selected signature.

- I want to create a new signature. – This option will allow a new signature to be created.

- I am a reporting agent. – This option will indicate a reporting agent signature method and will save this setting for the user profile on the computer. This can always be changed if needed.

- The OK button will proceed with the selected option.

- Cancel will return to the Form 8453-EMP window.

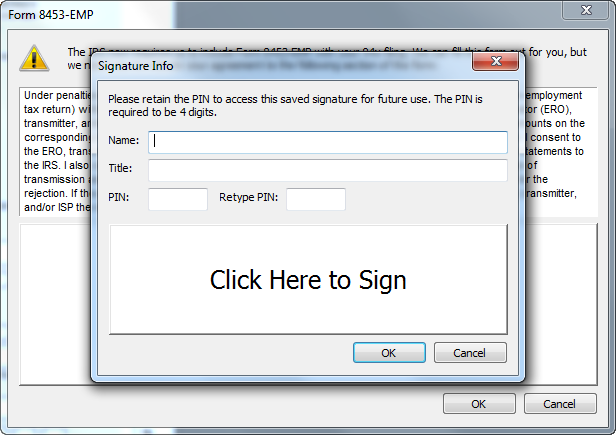

- The Signature Info window will appear if I want to create a new signature was selected in the 94x Signature Method window.

- To create a new signature, provide a Name, Title, PIN, and retype the PIN to verify. This PIN is required to be 4 digits and will be used when selecting to use or edit the signature in the future. This is a PIN that the signer creates and is stored with the company information. If the PIN is forgotten, a new signature would have to be created.

To add the actual signature, click the Click Here to Sign area. - The OK button will save the new signature and automatically load the new signature to be used. Signatures can be edited in the Company Setup in the Signature Setup screen.

- Cancel will return to the 94x Signature Method window to select a different option.

- To create a new signature, provide a Name, Title, PIN, and retype the PIN to verify. This PIN is required to be 4 digits and will be used when selecting to use or edit the signature in the future. This is a PIN that the signer creates and is stored with the company information. If the PIN is forgotten, a new signature would have to be created.

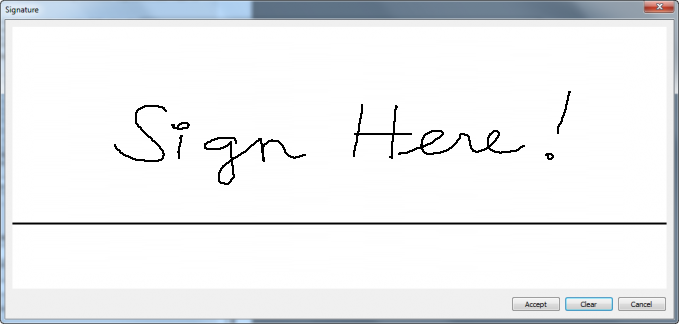

- The Signature window will appear after selecting the Click Here to Sign area in the Signature Info window.

Create a signature in the white space using the black line as a guide.

- The Accept button will save the signature and return to the Signature Info window.

- Clear will completely erase the existing signature to allow for starting over.

- Cancel will return to the Signature Info window.

- If a signature is selected or created, it will display on the Form 8453-EMP window.

A different signature method can be selected by clicking on the Signature image.

- The OK button will load the signature and continue to the eFile process as normal.

- Cancel will return to the form.

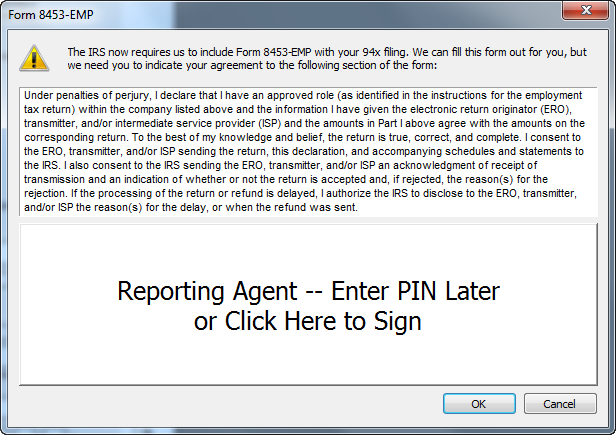

- If I am a reporting agent is selected as the signature method in the 94x Signature Method window, the clickable area will say Reporting Agent – Enter PIN Later.

A different signature method can be selected by clicking on the Reporting Agent – Enter PIN Later area.

- The OK button will continue to the eFile process as normal and a prompt to provide reporting agent information will be included as part of the eFile process if it is not already on file.

- Note: If your ETIN is only 5 digits, you may enter a leading zero in front of the existing 5 digits to make your ETIN 6 digits in length.

- Cancel will return to the form.

IRS Instructions

- Preparer:

To maintain compliance with the Federal Modernized eFile system, when a Federal 94x series form (940, 941, 943, etc) is selected to be eFiled, the prompt for selecting a signature method for the Form 8453-EMP will display. If you are an employee of the company(s) and not a paid Tax Preparer, please disregard the Reporting Agent instructions. Use the "I want to create a new signature" option instead.

If you are a Reporting Agent and the IRS has designated a 5-Digit Reporting Agent PIN to you based on your ETIN/EFIN, please provide that information the next time you eFile. The new eFile process will request a signature method for the 8453-EMP Form, one of the options is Reporting Agent.

Reporting Agent Instructions:

If you are not yet a Reporting Agent, please follow these steps to start the process through the e-Services IRS website:

1. Go to: https://www.irs.gov/

2. Click Tax Pros in the top right corner

3. Click Access e-Services in the e-Services box

4. Click E-file Provider Services

5. Click Access e-file Application

6. Sign in with your e-Services login

7. Click Continue on the Online Security Information page

8. Select your Organization's radio button and click Submit Selected Organization.

9. Click Start (if no Application has been done for this taxpayer before) It will be an e-File Application

10. Click Application Details Tab at the top of the screen if there is no Start button. Provider Options will be listed, if Reporting Agent is not available, click the Add Provider Option drop down to select Reporting Agent.

11. Follow the online instructions to become a Reporting Agent under Provider Options; be sure the Form Type chosen is 94X and Submit the application at the end. The letter containing your 5-digit Reporting Agent PIN from the IRS will take 1-2 weeks to arrive.

The Reporting Agent PIN will then be used for any Taxpayers for which you have submitted the appropriate Form 8655 to the IRS. You will then need to enter the Reporting Agent PIN, ETIN/EFIN, and Control Name for each Taxpayer when prompted. Reporting Agent information will be stored for each Taxpayer for future filings.

Please note the Control Name is unique for every Taxpayer. Please access the following link for helpful tips from the IRS website to aid in determining the correct Control Name for each Taxpayer.

http://www.irs.gov/Businesses/Corporations/Using-the-Correct-Name-Control-in-e-filing-Corporate-Tax-Returns

- To Determine ETIN:

1. Go to: http://www.irs.gov/Tax-Professionals/e-services---Online-Tools-for-Tax-Professionals

2. Click 'Login or Register'

3. Enter the Username and Password

4. Select your Organization's radio button and click Submit Selected Organization.

5. Click Application

6. Click e-File Application under Services on the left side of the screen

7. Click on the Existing Application

8. Click ETIN Status on the left side of the screen

9. The ETIN will be displayed.

- Taxpayer:

To maintain compliance with the Federal Modernized eFile system, when a Federal 94x series form (940, 941, 943, etc) is selected to be eFiled the prompt for selecting a signature method for the Form 8453-EMP will display. This process replaces the application for a 94x 10 digit Signature PIN.

If prompted, enter the unique Control Name for each Taxpayer. The IRS has a website that will aid in determining the correct Control Name for each Taxpayer.

http://www.irs.gov/Businesses/Corporations/Using-the-Correct-Name-Control-in-e-filing-Corporate-Tax-Returns

If you are not an employee, but are a Paid Tax Preparer for these company(s), please review the Reporting Agent instructions to establish yourself as a Reporting Agent with the IRS.