IRS FORM 1094-C

Last modified by andrew k on 2026/01/27 20:42

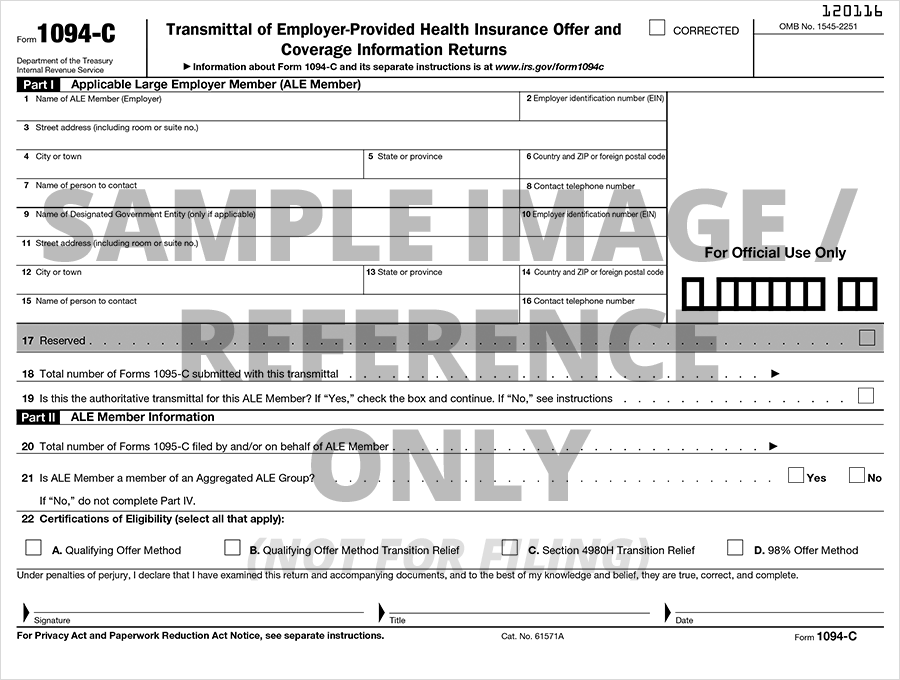

FORM 1094-C

Click on the individual boxes below for specific IRS Instructions

| Part II: ALE Member Information |

| Line 20, Total Number of Forms filed by and/or on behalf of the employer. |

| Line 21, ALE Member is part of Aggregated ALE Group |

| Line 22, Certifications of Eligibility |

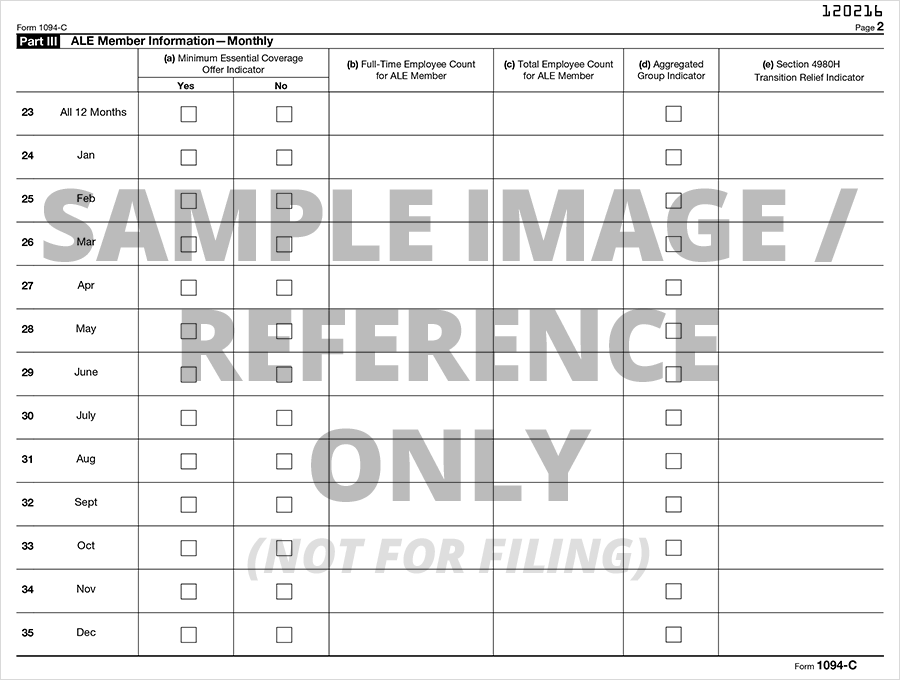

| Part III: ALE Member Information — Monthly (Lines 23–35) |

| Column (a), Minimum Essential Coverage |

| Column (b), Full-Time Employee Count for ALE Member |

| Column (c), Total Employee Count for ALE Member |

| Column (d), Aggregated Group Indicator |

| Column (e), Aggregated Group Indicator |

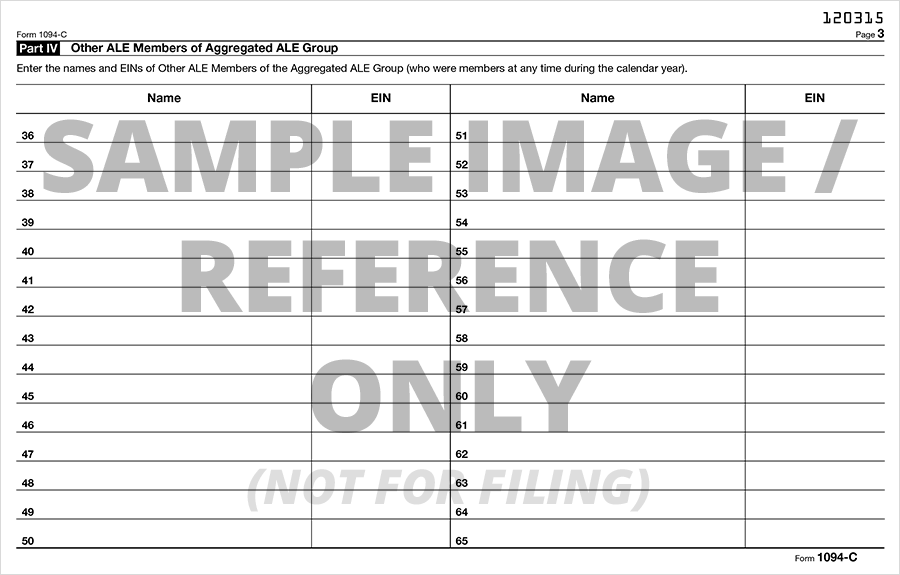

| Part IV: Other ALE Members of Aggregated ALE Group |

| Lines 36-65, Other ALE Members of Aggregated ALE Group |